Show me the money!

Financial Statements show us the money

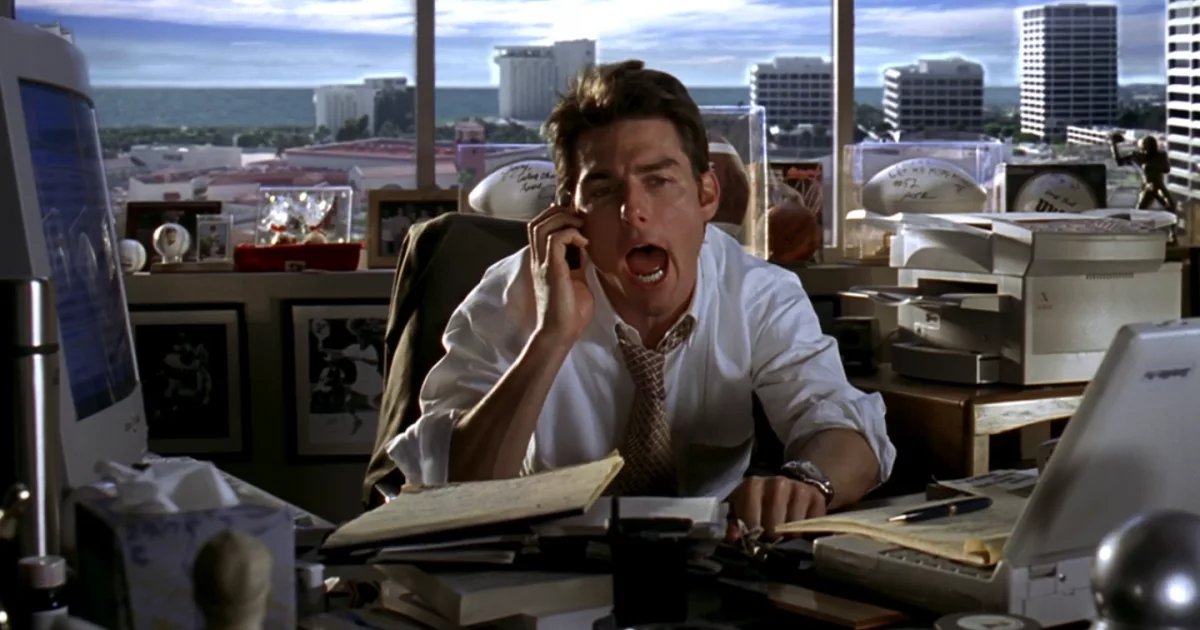

If you are Generation X, chances are you watched Jerry Maguire 1996 before. You remember Cuba Gooding Jr.’s and Tom Cruise’s immortal line from the movie: “Show me the money!”

That’s what financial statements do. They show you the money (cash flow). They show you where a company’s money (cash flow) came from, where it went, and where it is now. The big challenge is the cash flow a company generates is quite different from its profit.

There are three main financial statements:

| Balance Sheet | Shows what a company owns and what it owes at a fixed point in time. |

| Income Statement | Shows how much money a company made and spent over a period of time |

| Cash Flow Statement | Shows the exchange of money between a company and the outside world also over a period of time |

Statements of Shareholders’ Equity is the fourth financial statement, but it is to show changes in the interests of the company’s shareholders over time. By reading and linking up Balance Sheet, Income Statement and Cash Flow Statement, we are able to visualise the information shown in Statements of Shareholders’ Equity. Therefore, we won’t put high high emphasis on Statements of Shareholders’ Equity at this moment.

Accounting Regulations

Regulators set accounting standards to standardize financial information. There are two sets of accounting standards in the world: Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). GAAP and IFRS are co-exist with some differences. In this website, we focus on the IFRS standards, but where there are major differences, we will identify them.

What is Generally Accepted Accounting Principles (GAAP)?

GAAP is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC) where SEC is a U.S. federal agency established by the U.S. Congress in 1934. SEC authorizes the Financial Accounting Standards Board (FASB) to determine U.S. accounting rules. FASB communicates these rules through the issuance of Statements of Financial Accounting Standards (SFAS). These statements make up the body of accounting rules known as the GAAP.

What is International Financial Reporting Standards (IFRS)?

IFRS are a set of accounting rules for the financial statements of public companies that are intended to make them consistent, transparent, and easily comparable around the world. The IFRS are issued by the International Accounting Standards Board (IASB).

Over 100 countries, including the EU, UK, Canada, Australia, Russia (see map) have adopted a unified set of international accounting standards (IFRS). Many other countries like China, India, Brazil, are either actively pursuing convergence with IFRS or have incorporated IFRS standards into their national accounting standards.