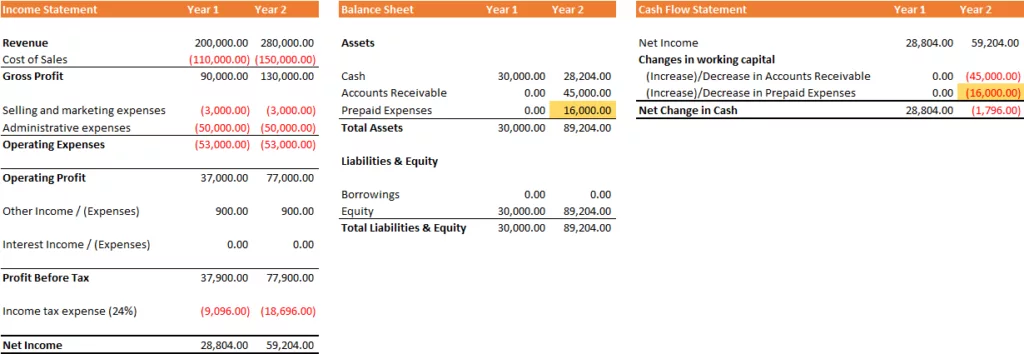

Prepaid Expenses

Landlord offers discount if we pay rental in advance

For some inexplicable reason, our landlord offers us better rates if we pay the rent in advance. For example, if we normally pay $6,000 in rent each month, we can pay only $16,000 for 3 months instead of $18,000 if we pay it 3 months in advance.

The income statement remains unchanged when we make the first cash payment because the expense has not yet been incurred. We do not begin to recognise the rental expense until we use the shop for the first of the three months. We must recognise Prepaid Expenses as an asset in the Balance Sheet because they provide us with a future benefit.

| Balance Sheet | Year 1 | Year 2 |

| Assets | ||

| Cash | 30,000.00 | 28,204.00 |

| Accounts Receivable | 0.00 | 45,000.00 |

| Prepaid Expenses | 0.00 | 16,000.00 |

| Total Assets | 30,000.00 | 89,204.00 |

| Liabilities & Equity | ||

| Borrowings | 0.00 | 0.00 |

| Equity | 30,000.00 | 89,204.00 |

| Total Liabilities & Equity | 30,000.00 | 89,204.00 |

However, since we made this cash payment in advance, there is another difference between Net Income and Cash Generated. The “Change in Prepaid Expenses” is shown as negative in Cash Flow Statement because it reduces our cash flow.

| Cash Flow Statement | Year 1 | Year 2 |

| Net Income | 28,804.00 | 59,204.00 |

| Changes in working capital | ||

| (Increase)/Decrease in Accounts Receivable | 0.00 | (45,000.00) |

| (Increase)/Decrease in Prepaid Expenses | 0.00 | (16,000.00) |

| Net Change in Cash | 28,804.00 | (1,796.00) |

Impact of Prepaid Expenses to the Financial Statements in a Glance