Inventory

We start selling frozen foods 🥳

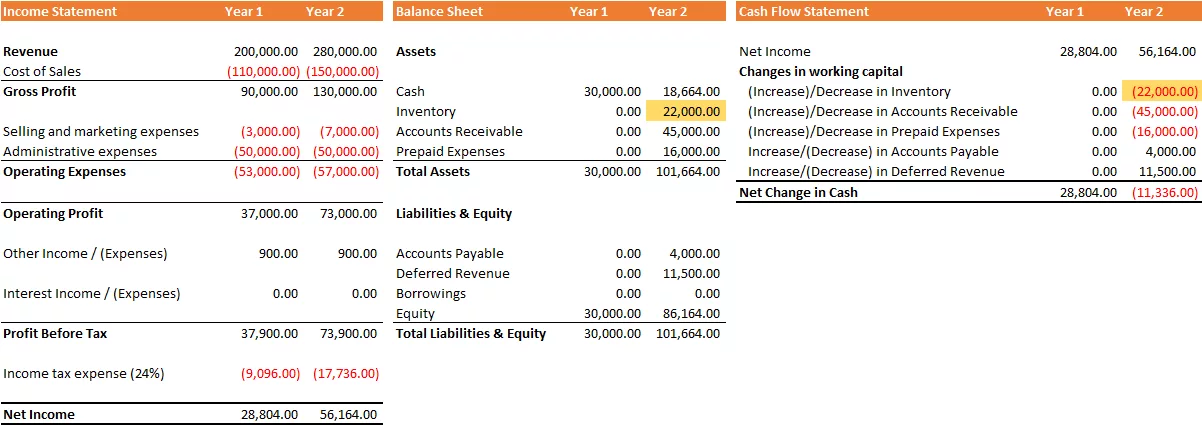

Since our restaurant still have space, we decided to buy one large freezer (How do we capitalize the purchase of this freezer?) to store and sell frozen foods. We need to buy frozen foods from our suppliers before we sell them. Although we must pay cash for these supplies, we cannot report them as expenses on the Income Statement until we sell the products.

So, our income statement has not changed: Net Income is still $56,164. Our Net Change in cash is decreasing due to inventory purchases, which we have set at $22,000 as shown below. Since we buy inventory from our suppliers, we report this with a negative value; it decreases our cash flow.

| Cash Flow Statement | Year 1 | Year 2 |

| Net Income | 28,804.00 | 56,164.00 |

| Changes in working capital | ||

| (Increase)/Decrease in Inventory | 0.00 | (22,000.00) |

| (Increase)/Decrease in Accounts Receivable | 0.00 | (45,000.00) |

| (Increase)/Decrease in Prepaid Expenses | 0.00 | (16,000.00) |

| Increase/(Decrease) in Accounts Payable | 0.00 | 4,000.00 |

| Increase/(Decrease) in Deferred Revenue | 0.00 | 11,500.00 |

| Net Change in Cash | 28,804.00 | (11,336.00) |

We need to show Inventory as an asset on the Balance Sheet because we can sell inventory to make money in the future. If inventory were to decrease, the scenario would be reversed: we would list it in the income statement under Cost of Sales, along with the revenue from the sale of the products, and the Change in Inventory would be positive in the Cash Flow Statement.

| Balance Sheet | Year 1 | Year 2 |

| Assets | ||

| Cash | 30,000.00 | 18,664.00 |

| Inventory | 0.00 | 22,000.00 |

| Accounts Receivable | 0.00 | 45,000.00 |

| Prepaid Expenses | 0.00 | 16,000.00 |

| Total Assets | 30,000.00 | 101,664.00 |

| Liabilities & Equity | ||

| Accounts Payable | 0.00 | 4,000.00 |

| Deferred Revenue | 0.00 | 11,500.00 |

| Borrowings | 0.00 | 0.00 |

| Equity | 30,000.00 | 86,164.00 |

| Total Liabilities & Equity | 30,000.00 | 101,664.00 |

Impact of Inventory to the Financial Statements in a Glance