Deferred Revenue

We start selling gift vouchers 🥳

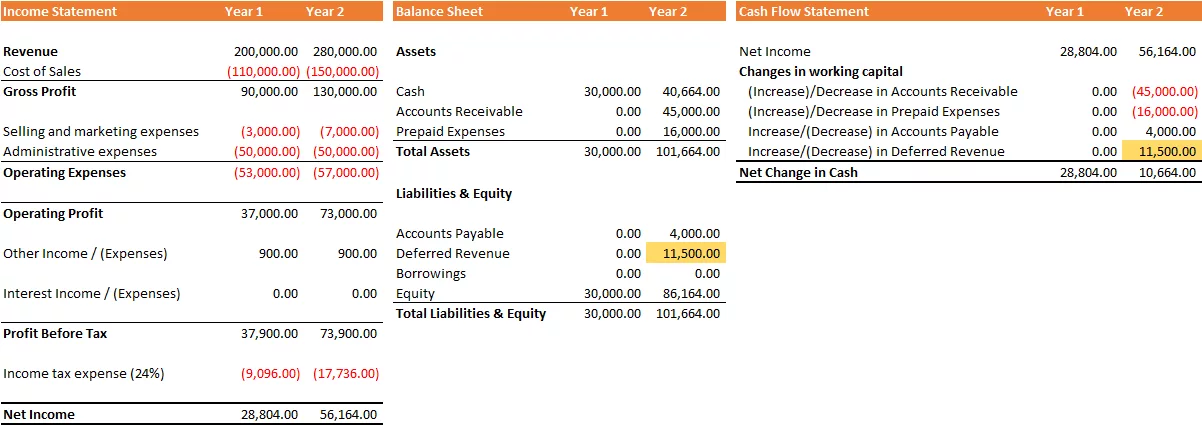

We have another brilliant idea and decide to sell gift vouchers. Customers have to pay for the gift vouchers in advance and then they can redeem them to buy health products or ready-to-eat foods from us. We have successfully sold $11,500 worth of gift vouchers, and received $11,500 in payments from customers. We cannot yet recognize any of this as revenue because we have not yet delivered the food. Therefore, our Income Statement has not changed yet.

| Income Statement | Year 1 | Year 2 |

| Revenue | 200,000.00 | 280,000.00 |

| Cost of Sales | (110,000.00) | (150,000.00) |

| Gross Profit | 90,000.00 | 130,000.00 |

| Selling and marketing expenses | (3,000.00) | (7,000.00) |

| Administrative expenses | (50,000.00) | (50,000.00) |

| Operating Expenses | (53,000.00) | (57,000.00) |

| Operating Profit | 37,000.00 | 73,000.00 |

| Other Income / (Expenses) | 900.00 | 900.00 |

| Interest Income / (Expenses) | 0.00 | 0.00 |

| Profit Before Tax | 37,900.00 | 73,900.00 |

| Income tax expense (24%) | (9,096.00) | (17,736.00) |

| Net Income | 28,804.00 | 56,164.00 |

To deal with this situation, we create an entry in Balance Sheet called Deferred Revenue (as a liability) and reflect the cash collected in advance in the Cash Flow Statement. Deferred Revenue is a liability because we must provide the services in the future.

| Balance Sheet | Year 1 | Year 2 |

| Assets | ||

| Cash | 30,000.00 | 40,664.00 |

| Accounts Receivable | 0.00 | 45,000.00 |

| Prepaid Expenses | 0.00 | 16,000.00 |

| Total Assets | 30,000.00 | 101,664.00 |

| Liabilities & Equity | ||

| Accounts Payable | 0.00 | 4,000.00 |

| Deferred Revenue | 0.00 | 11,500.00 |

| Borrowings | 0.00 | 0.00 |

| Equity | 30,000.00 | 86,164.00 |

| Total Liabilities & Equity | 30,000.00 | 101,664.00 |

Our Net Change in Cash is different from Net Income because we received cash payments from customers before we delivered anything. When Deferred Revenue increases, it means we have received cash but cannot yet recognize it as revenue, and this increases our cash balance. When Deferred Revenue decreases, it means we can finally recognize that cash as revenue because we have delivered the product or service to customers. As a result, our cash balance decreases.

| Cash Flow Statement | Year 1 | Year 2 |

| Net Income | 28,804.00 | 56,164.00 |

| Changes in working capital | ||

| (Increase)/Decrease in Accounts Receivable | 0.00 | (45,000.00) |

| (Increase)/Decrease in Prepaid Expenses | 0.00 | (16,000.00) |

| Increase/(Decrease) in Accounts Payable | 0.00 | 4,000.00 |

| Increase/(Decrease) in Deferred Revenue | 0.00 | 11,500.00 |

| Net Change in Cash | 28,804.00 | 10,664.00 |

Impact of Deferred Revenue to the Financial Statements in a Glance