Cash-basis

A Cash Business

We just opened “Organic Food Everyday” in an industrial park. The business model is quite simple. Customers pay for the ready-to-eat food to our cashier, and the customers take the food with them.

There are no factories or offices, minimal capital is required, and we don’t have to keep inventory because we can consume most of the ingredients and sell all ready-to-eat food within 1 day.

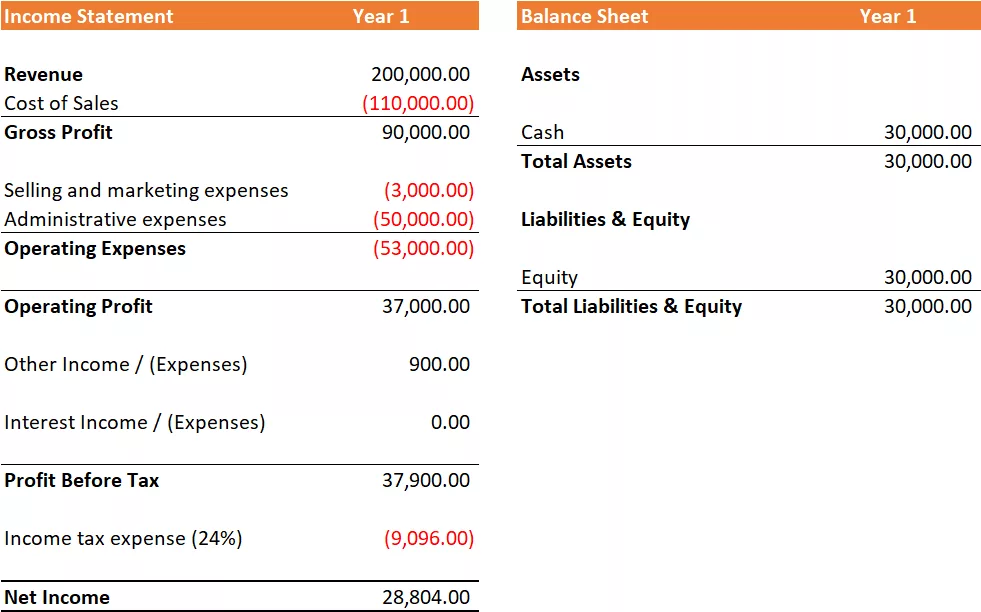

If we tracked the sales, expenses, and profits for this business, the Income Statement would look like below.

| Income Statement | Year 1 |

|---|---|

| Revenue | 200,000.00 |

| Cost of Sales | (110,000.00) |

| Gross Profit | 90,000.00 |

| Selling and marketing expenses | (3,000.00) |

| Administrative expenses | (50,000.00) |

| Operating Expenses | (53,000.00) |

| Operating Profit | 37,000.00 |

| Other Income / (Expenses) | 900.00 |

| Interest Income / (Expenses) | 0.00 |

| Profit Before Tax | 37,900.00 |

| Income tax expense (24%) | (9,096.00) |

| Net Income | 28,804.00 |

Revenue represents our total sales where we collect money from customers after delivering food to them and record the collected money as Revenue. Cost of Sales represents expenses that can be associated with individual units sold (e.g., ingredients or human labour for preparation).

The Gross Profit tells us how much potential profit we would earn from revenue before fixed expenses like employee salaries and rent.

Operating Expenses include items that cannot be associated with food sold, such as marketing, rent, employee salaries, and electric bills.

Operating Profit indicates how much the company earned before we consider “side activities,” interest, and taxes. We will cover “sideline activities” (non-operating income/expenses) in a later chapter.

Net Income tells us the bottom line of our business: how much we have earned after deducting all taxes and expenses.

Accounting is quite simple, because when we sell something, we receive the actual amount of money for it, and when we make an expenditure, we pay it in cash. In this simple case, the net income is roughly equal to the cash flow generated each year.

For simplicity, the balance sheet of our restaurant is as follows. At this point, you should have noticed Cash and Equity in the Balance Sheet. Cash is the cash on hand in our bank account. Equity is a source of funding for the business that does not result in future cash costs, for example, because we used our savings as capital to start the business.

| Balance Sheet | Year 1 |

|---|---|

| Assets | |

| Cash | 30,000.00 |

| Total Assets | 30,000.00 |

| Liabilities & Equity | |

| Equity | 30,000.00 |

| Total Liabilities & Equity | 30,000.00 |

At this point, you can see that two financial statements are sufficient for a cash business. However, things get more complicated if we decide to expand our business. Then we need three financial statements to link up to find out where our money has gone.

Cash-basis Financial Statements in a Glance