Accounts Receivable

30-day Credit for Lunch Catering

Due to the increase in commercial activity and proximity to residential areas, there are tremendous opportunities in providing lunch catering to nearby offices during work days. For the few established corporate clients near our store, we offer them the opportunity to take advantage of our lunch catering services with a 30-day credit. This means that we deliver lunch to them every day and send them an invoice at the end of the month. They then have 30 days to pay us. (We know this is risky, but we want more sales and more market share.)

In this case, we must recognize the lunch sold as revenue in advance, even if we have not yet received full cash payment from customers. This is required because revenue recognition is based on the delivery of the products or services. Here you can see how revenue compares to cash received:

| Month 1 | Month 2 | Month 3 | Month 4 | |

| Revenue | 1,000 | 1,000 | 1,000 | 1,000 |

| Cash Received | 0 | 1,000 | 1,000 | 1,000 |

| Month 1 | Month 2 | Month 3 | Month 4 | |

| Revenue | 1,000 | 1,000 | 1,000 | 1,000 |

| Cash Received | 1,000 | 1,000 | 1,000 | 1,000 |

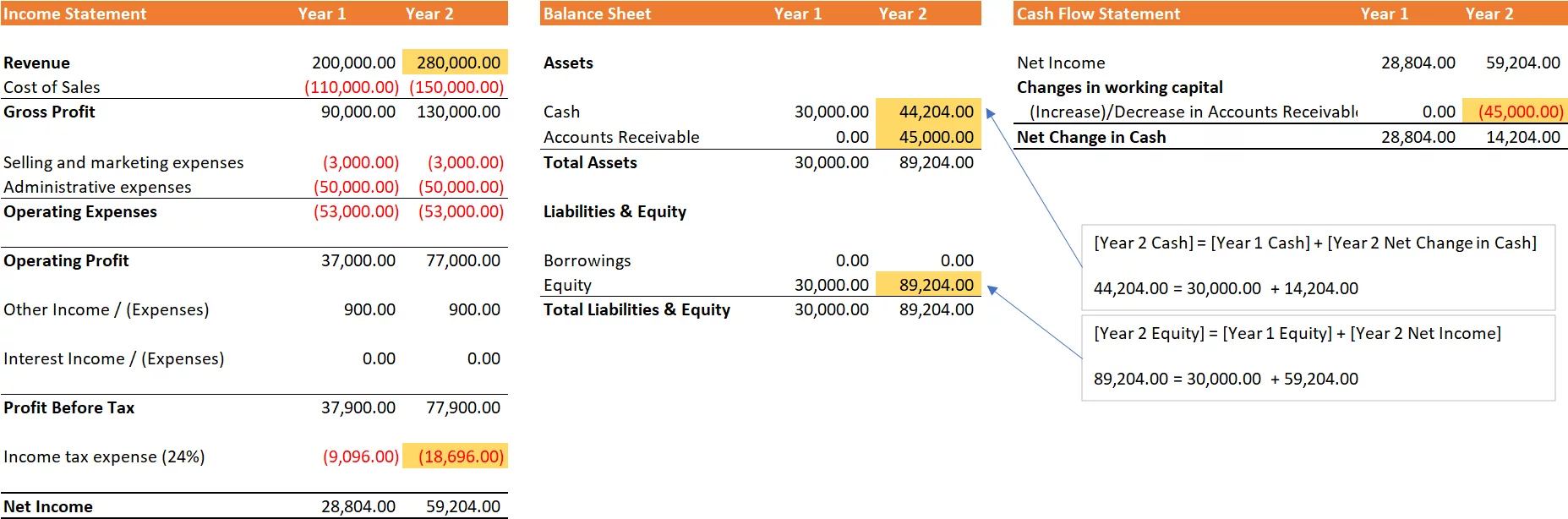

Here comes three financial statements

We have received overwhelming response from nearby offices to our lunch catering services. We are generating $80,000 in additional revenue from the lunch catering. Some customers pay immediately upon delivery, while others take a 30-day credit. The total amount of customers taking the 30-day credit is $45,000. Since the revenue is based on the delivery of the package, the income statement below shows $80,000 in revenue.

| Income Statement | Year 1 | Year 2 |

| Revenue | 200,000.00 | 280,000.00 |

| Cost of Sales | (110,000.00) | (150,000.00) |

| Gross Profit | 90,000.00 | 130,000.00 |

| Selling and marketing expenses | (3,000.00) | (3,000.00) |

| Administrative expenses | (50,000.00) | (50,000.00) |

| Operating Expenses | (53,000.00) | (53,000.00) |

| Operating Profit | 37,000.00 | 77,000.00 |

| Other Income / (Expenses) | 900.00 | 900.00 |

| Interest Income / (Expenses) | 0.00 | 0.00 |

| Profit Before Tax | 37,900.00 | 77,900.00 |

| Income tax expense (24%) | (9,096.00) | (18,696.00) |

| Net Income | 28,804.00 | 59,204.00 |

However, because we did not collect this $80,000 in revenue in cash, our cash balance did not increase by $80,000. The “cash we are waiting for” is called Accounts Receivable, and we must account for it by adjusting the net income of the business. On the balance sheet, we must show $45,000 for accounts receivable.

Thus, offering a 30-day credit created a difference between Net Income and Cash Generated. We earned $59,204 in Net Income but only $14,204 in cash, leaving us $45,000 short in cash.

| Cash Flow Statement | Year 1 | Year 2 |

| Net Income | 28,804.00 | 59,204.00 |

| Changes in working capital | ||

| (Increase)/Decrease in Accounts Receivable | 0.00 | (45,000.00) |

| Net Change in Cash | 28,804.00 | 14,204.00 |

In addition, Accounts Receivable must be reported as an asset on the balance sheet because the receivables will earn us an amount of money in the future. Every time a company orders our service but does not pay 100% in cash up front, the Accounts Receivables balance will increase and our cash profit will be less than the net income. When we finally receive the cash from the customer, the Accounts Receivable balance decreases. As a result, this will increase the “Net Change in Cash” in the Cash Flow Statement.

| Balance Sheet | Year 1 | Year 2 | Explanation |

| Assets | |||

| Cash | 30,000.00 | 44,204.00 | |

| Accounts Receivable | 0.00 | 45,000.00 | [Year 2 Cash] = [Year 1 Cash] + [Year 2 Net Change in Cash] 44,204.00 = 30,000.00 + 14,204.00 |

| Total Assets | 30,000.00 | 89,204.00 | |

| Liabilities & Equity | |||

| Borrowings | 0.00 | 0.00 | |

| Equity | 30,000.00 | 89,204.00 | [Year 2 Equity] = [Year 1 Equity] + [Year 2 Net Income] 89,204.00 = 30,000.00 + 59,204.00 |

| Total Liabilities & Equity | 30,000.00 | 89,204.00 |

Impact of Accounts Receivable to the Financial Statements in a Glance