Accounts Payable

Marketing firm will give us 30 days credit term

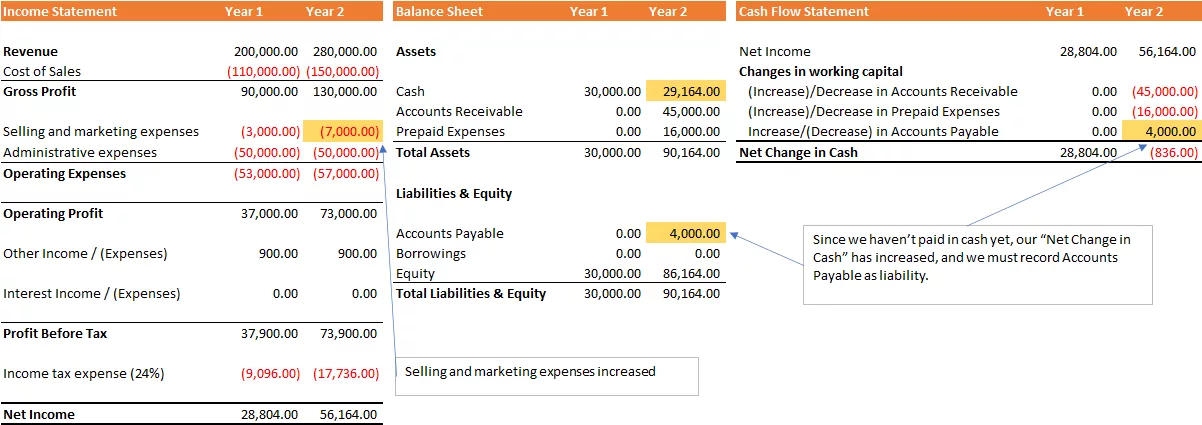

We strongly believe that social media marketing will increase our brand awareness, but we are not versed in social media marketing. Therefore, we decide to hire a marketing firm to do social media marketing for our company. We receive an invoice after the marketing company places ads on Facebook, Instagram, and Twitter. The marketing company gives us a payment term of 30 days.

If the marketing firm’s services cost $4,000, we would have to record the expense on our Income Statement as the services are rendered. Our “Sales & Marketing Expense” increases from $3,000 to $7,000 as a result. Our Net Income falls to $56,164.

| Income Statement | Year 1 | Year 2 | Explanation |

|---|---|---|---|

| Revenue | 200,000.00 | 280,000.00 | |

| Cost of Sales | (110,000.00) | (150,000.00) | |

| Gross Profit | 90,000.00 | 130,000.00 | |

| Selling and marketing expenses | (3,000.00) | (7,000.00) | Selling and marketing expenses increased 4,000 |

| Administrative expenses | (50,000.00) | (50,000.00) | |

| Operating Expenses | (53,000.00) | (57,000.00) | |

| Operating Profit | 37,000.00 | 73,000.00 | |

| Other Income / (Expenses) | 900.00 | 900.00 | |

| Interest Income / (Expenses) | 0.00 | 0.00 | |

| Profit Before Tax | 37,900.00 | 73,900.00 | |

| Income tax expense (24%) | (9,096.00) | (17,736.00) | |

| Net Income | 28,804.00 | 56,164.00 |

Since we did not pay these expenses in cash upfront, our “Net Change in Cash” (in the Cash Flow Statement ) increased.

| Cash Flow Statement | Year 1 | Year 2 | Explanation |

|---|---|---|---|

| Net Income | 28,804.00 | 56,164.00 | |

| Changes in working capital | |||

| (Increase)/Decrease in Accounts Receivable | 0.00 | (45,000.00) | |

| (Increase)/Decrease in Prepaid Expenses | 0.00 | (16,000.00) | |

| Increase/(Decrease) in Accounts Payable | 0.00 | 4,000.00 | Since we haven’t paid in cash yet, our “Net Change in Cash” has increased. 4,000 will be removed when we pay 4,000 to the marketing firm. |

| Net Change in Cash | 28,804.00 | (836.00) |

We track these “payments owed” in line items called Accounts Payable. Accounts payable represents bills the company owes for goods or services it hasn’t paid for yet.

Accounts Payable is a liability on the balance sheet because they will result in less cash in the future. When they increase, our cash flow increases because we “defer” payment. If they decrease, our cash flow decreases because we eventually pay in cash.

| Balance Sheet | Year 1 | Year 2 | Explanation |

|---|---|---|---|

| Assets | |||

| Cash | 30,000.00 | 29,164.00 | |

| Accounts Receivable | 0.00 | 45,000.00 | |

| Prepaid Expenses | 0.00 | 16,000.00 | |

| Total Assets | 30,000.00 | 90,164.00 | |

| Liabilities & Equity | |||

| Accounts Payable | 0.00 | 4,000.00 | Because we must pay 4,000 in near future, we must record Accounts Payable as liability. |

| Borrowings | 0.00 | 0.00 | |

| Equity | 30,000.00 | 86,164.00 | |

| Total Liabilities & Equity | 30,000.00 | 90,164.00 |

Impact of Accounts Payable to the Financial Statements in a Glance