Short-Term Investments

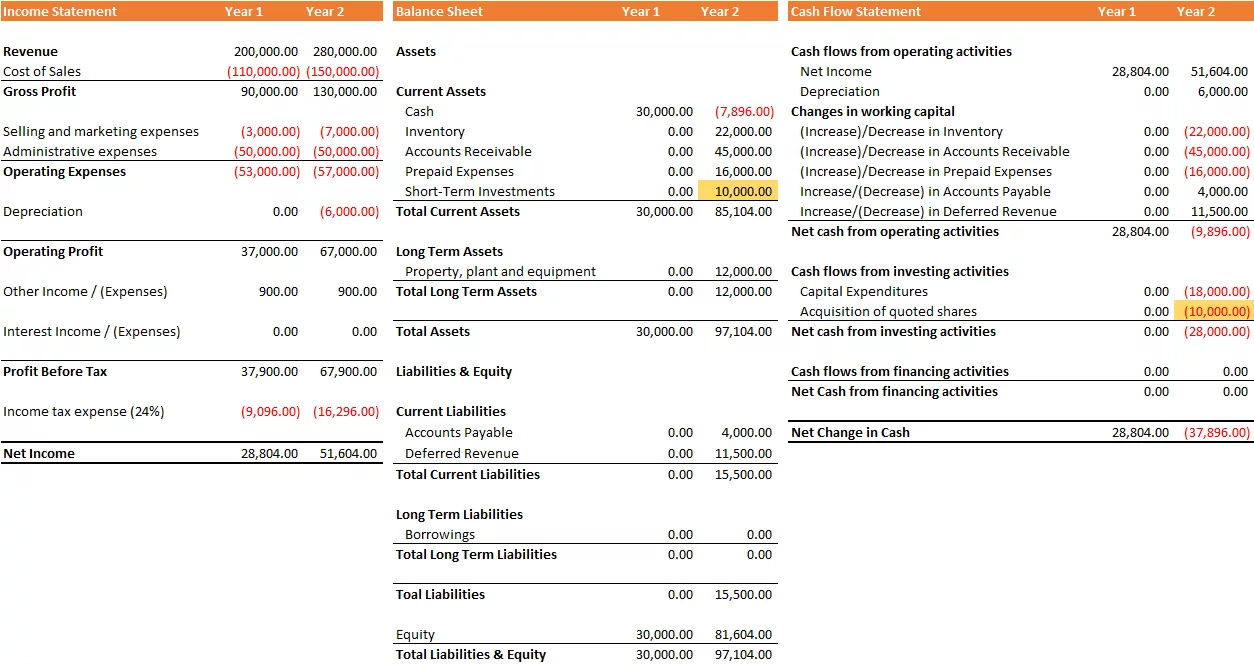

Since we have some extra cash, we decided to invest $10,000 in a public traded company as short-term investment.

We record the cash invested $10,000, as Acquisition of quoted shares, in Cash Flows from Investing Activities on the Cash Flow Statement because this item does not impact a company’s taxes initially.

| Cash Flow Statement | Year 1 | Year 2 |

| Cash flows from operating activities | ||

| Net Income | 28,804.00 | 51,604.00 |

| Depreciation | 0.00 | 6,000.00 |

| Changes in working capital | ||

| (Increase)/Decrease in Inventory | 0.00 | (22,000.00) |

| (Increase)/Decrease in Accounts Receivable | 0.00 | (45,000.00) |

| (Increase)/Decrease in Prepaid Expenses | 0.00 | (16,000.00) |

| Increase/(Decrease) in Accounts Payable | 0.00 | 4,000.00 |

| Increase/(Decrease) in Deferred Revenue | 0.00 | 11,500.00 |

| Net cash from operating activities | 28,804.00 | (9,896.00) |

| Cash flows from investing activities | ||

| Capital Expenditures | 0.00 | (18,000.00) |

| Acquisition of quoted shares | 0.00 | (10,000.00) |

| Net cash from investing activities | 0.00 | (28,000.00) |

| Cash flows from financing activities | 0.00 | 0.00 |

| Net Cash from financing activities | 0.00 | 0.00 |

| Net Change in Cash | 28,804.00 | (37,896.00) |

We also need to record this investment in our Balance Sheet as Short-Term Investment because this is our intent.

| Balance Sheet | Year 1 | Year 2 |

| Assets | ||

| Current Assets | ||

| Cash | 30,000.00 | (7,896.00) |

| Inventory | 0.00 | 22,000.00 |

| Accounts Receivable | 0.00 | 45,000.00 |

| Prepaid Expenses | 0.00 | 16,000.00 |

| Short-Term Investments | 0.00 | 10,000.00 |

| Total Current Assets | 30,000.00 | 85,104.00 |

| Long Term Assets | ||

| Property, plant and equipment | 0.00 | 12,000.00 |

| Total Long Term Assets | 0.00 | 12,000.00 |

| Total Assets | 30,000.00 | 97,104.00 |

| Liabilities & Equity | ||

| Current Liabilities | ||

| Accounts Payable | 0.00 | 4,000.00 |

| Deferred Revenue | 0.00 | 11,500.00 |

| Total Current Liabilities | 0.00 | 15,500.00 |

| Long Term Liabilities | ||

| Borrowings | 0.00 | 0.00 |

| Total Long Term Liabilities | 0.00 | 0.00 |

| Toal Liabilities | 0.00 | 15,500.00 |

| Equity | 30,000.00 | 81,604.00 |

| Total Liabilities & Equity | 30,000.00 | 97,104.00 |

If the public traded company pay us dividends, we will record the dividends as investment income in the Income Statement. That is because we must pay taxes on the income we earn from the investment.

There is no associated non-cash adjustment here. The interest or investment income is earned in cash and incurs cash taxes. Cash taxes represent taxes paid in cash (complicated topic).

Impact of Short-Term Investments to the Financial Statements in a Glance