Share Buyback

In a share buyback, the company buys back your shares so that you no longer own a percentage of the company. For example, if you bought a share for $20.00, the company might offer to buy it back for $18.00 or $22.00. Share repurchases do not affect a company’s taxes, so this transaction is not reported in the Income Statement. Share repurchases are reported as a negative item in the Cash flows from financing activities section.

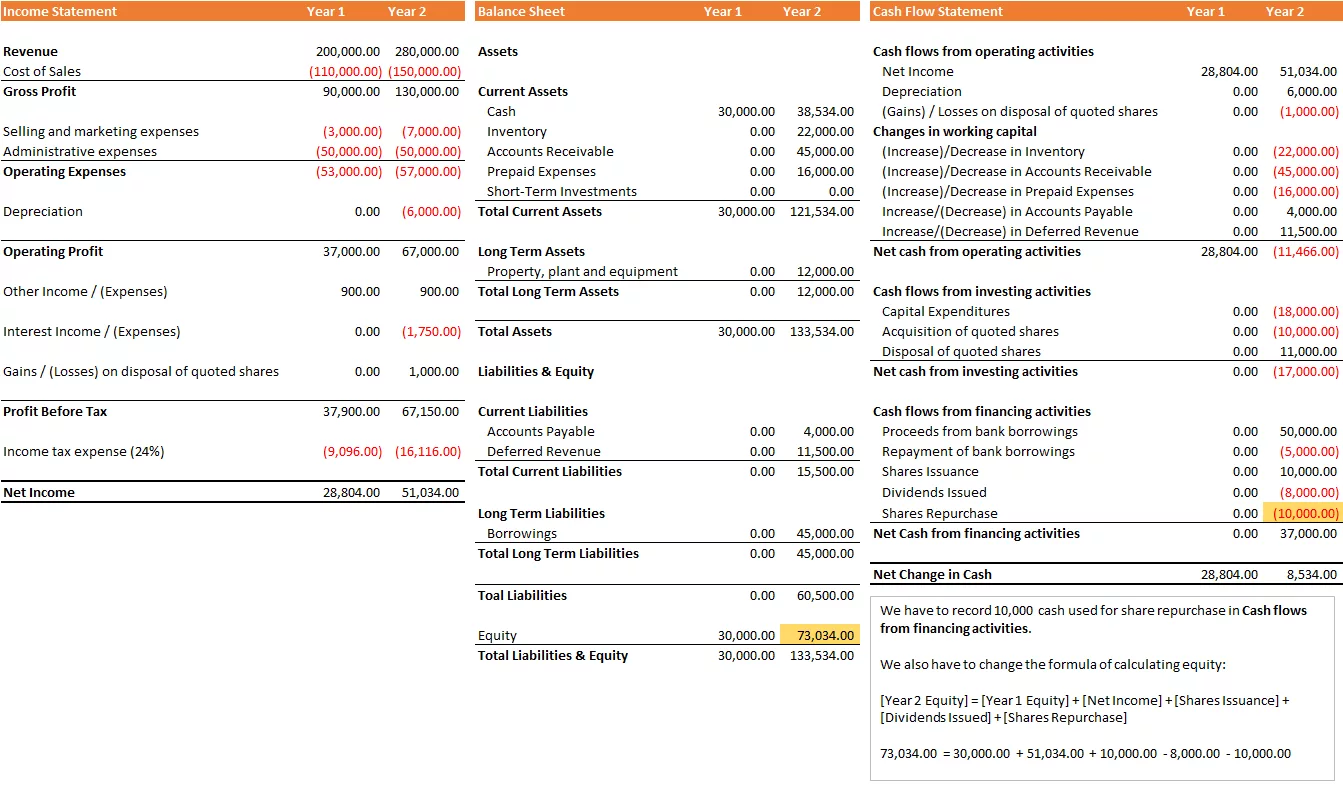

For the case of “Organic Food Everyday”, one founder decided to exit where he will sell all his shares to the company for $10,000.00. We will buy his portion of shares. We have to record 10,000 cash used for share repurchase in the Cash flows from financing activities section.

| Cash Flow Statement | Year 1 | Year 2 |

| Cash flows from operating activities | ||

| Net Income | 28,804.00 | 51,034.00 |

| Depreciation | 0.00 | 6,000.00 |

| (Gains) / Losses on disposal of quoted shares | 0.00 | (1,000.00) |

| Changes in working capital | ||

| (Increase)/Decrease in Inventory | 0.00 | (22,000.00) |

| (Increase)/Decrease in Accounts Receivable | 0.00 | (45,000.00) |

| (Increase)/Decrease in Prepaid Expenses | 0.00 | (16,000.00) |

| Increase/(Decrease) in Accounts Payable | 0.00 | 4,000.00 |

| Increase/(Decrease) in Deferred Revenue | 0.00 | 11,500.00 |

| Net cash from operating activities | 28,804.00 | (11,466.00) |

| Cash flows from investing activities | ||

| Capital Expenditures | 0.00 | (18,000.00) |

| Acquisition of quoted shares | 0.00 | (10,000.00) |

| Disposal of quoted shares | 0.00 | 11,000.00 |

| Net cash from investing activities | 0.00 | (17,000.00) |

| Cash flows from financing activities | ||

| Proceeds from bank borrowings | 0.00 | 50,000.00 |

| Repayment of bank borrowings | 0.00 | (5,000.00) |

| Shares Issuance | 0.00 | 10,000.00 |

| Dividends Issued | 0.00 | (8,000.00) |

| Shares Repurchase | 0.00 | (10,000.00) |

| Net Cash from financing activities | 0.00 | 37,000.00 |

| Net Change in Cash | 28,804.00 | 8,534.00 |

Share buyback will reduce Equity and Cash Balance in the Balance Sheet.

| Balance Sheet | Year 1 | Year 2 | Explanation |

|---|---|---|---|

| Assets | |||

| Current Assets | |||

| Cash | 30,000.00 | 38,534.00 | |

| Inventory | 0.00 | 22,000.00 | |

| Accounts Receivable | 0.00 | 45,000.00 | |

| Prepaid Expenses | 0.00 | 16,000.00 | |

| Short-Term Investments | 0.00 | 0.00 | |

| Total Current Assets | 30,000.00 | 121,534.00 | |

| Long Term Assets | |||

| Property, plant and equipment | 0.00 | 12,000.00 | |

| Total Long Term Assets | 0.00 | 12,000.00 | |

| Total Assets | 30,000.00 | 133,534.00 | |

| Liabilities & Equity | |||

| Current Liabilities | |||

| Accounts Payable | 0.00 | 4,000.00 | |

| Deferred Revenue | 0.00 | 11,500.00 | |

| Total Current Liabilities | 0.00 | 15,500.00 | |

| Long Term Liabilities | |||

| Borrowings | 0.00 | 45,000.00 | |

| Total Long Term Liabilities | 0.00 | 45,000.00 | |

| Toal Liabilities | 0.00 | 60,500.00 | |

| Equity | 30,000.00 | 73,034.00 | We also have to change the formula of calculating equity: [Year 2 Equity] = [Year 1 Equity] + [Net Income] + [Shares Issuance] + [Dividends Issued] + [Shares Repurchase] 73,034.00 = 30,000.00 + 51,034.00 + 10,000.00 – 8,000.00 – 10,000.00 |

| Total Liabilities & Equity | 30,000.00 | 133,534.00 |

Impact of Share Buyback to the Financial Statements in a Glance