Selling Assets or Investments

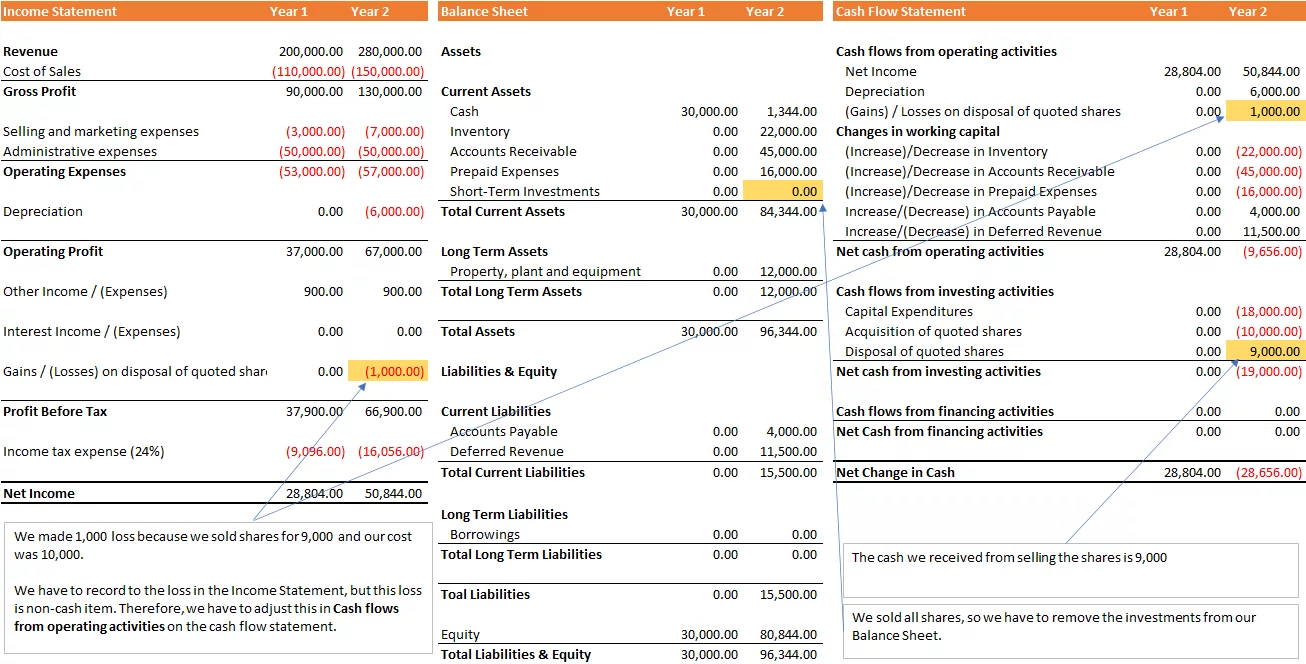

Selling Assets or Investments with Gain

What happens to our financial statements if we sell all shares for $11,000 in the same year? This means that we made a profit of $1,000 profit from selling the shares. The gain must be recognised in the Income Statement because the gain impacts our tax. However, we do not gain $10,000 in cash in this period, but it is a cash gain relative to what we paid for the asset, be it in the same period or different period.

Keep in mind that the Income Statement and Cash Flow Statement show us only what is happening in this period. Therefore, due to timing differences, we must take the gain as a non-cash adjustment in the Cash Flow Statement.

| Income Statement | Year 1 | Year 2 |

| Revenue | 200,000.00 | 280,000.00 |

| Cost of Sales | (110,000.00) | (150,000.00) |

| Gross Profit | 90,000.00 | 130,000.00 |

| Selling and marketing expenses | (3,000.00) | (7,000.00) |

| Administrative expenses | (50,000.00) | (50,000.00) |

| Operating Expenses | (53,000.00) | (57,000.00) |

| Depreciation | 0.00 | (6,000.00) |

| Operating Profit | 37,000.00 | 67,000.00 |

| Other Income / (Expenses) | 900.00 | 900.00 |

| Interest Income / (Expenses) | 0.00 | 0.00 |

| Gains / (Losses) on disposal of quoted shares | 0.00 | 1,000.00 |

| Profit Before Tax | 37,900.00 | 68,900.00 |

| Income tax expense (24%) | (9,096.00) | (16,536.00) |

| Net Income | 28,804.00 | 52,364.00 |

Because adding $1,000 gain to the Income Statement caused higher Net Income in the Cash Flow Statement,

- we deduct the Gain of $1,000 in the Cash Flows From Operating Activities section

- $11,000 will show up in the Cash Flows From Investing Activities section as a result of

- add back the $1,000 again,

- add the book value of $10,000 for the Assets we just sold.

Another reason we need to do this is the gains (or losses) of selling assets/investments are not relate to our core business operations, so they should be parked in the Cash Flows From Investing Activities section.

| Cash Flow Statement | Year 1 | Year 2 |

| Cash flows from operating activities | ||

| Net Income | 28,804.00 | 52,364.00 |

| Depreciation | 0.00 | 6,000.00 |

| (Gains) / Losses on disposal of quoted shares | 0.00 | (1,000.00) |

| Changes in working capital | ||

| (Increase)/Decrease in Inventory | 0.00 | (22,000.00) |

| (Increase)/Decrease in Accounts Receivable | 0.00 | (45,000.00) |

| (Increase)/Decrease in Prepaid Expenses | 0.00 | (16,000.00) |

| Increase/(Decrease) in Accounts Payable | 0.00 | 4,000.00 |

| Increase/(Decrease) in Deferred Revenue | 0.00 | 11,500.00 |

| Net cash from operating activities | 28,804.00 | (10,136.00) |

| Cash flows from investing activities | ||

| Capital Expenditures | 0.00 | (18,000.00) |

| Acquisition of quoted shares | 0.00 | (10,000.00) |

| Disposal of quoted shares | 0.00 | 11,000.00 |

| Net cash from investing activities | 0.00 | (17,000.00) |

| Cash flows from financing activities | 0.00 | 0.00 |

| Net Cash from financing activities | 0.00 | 0.00 |

| Net Change in Cash | 28,804.00 | (27,136.00) |

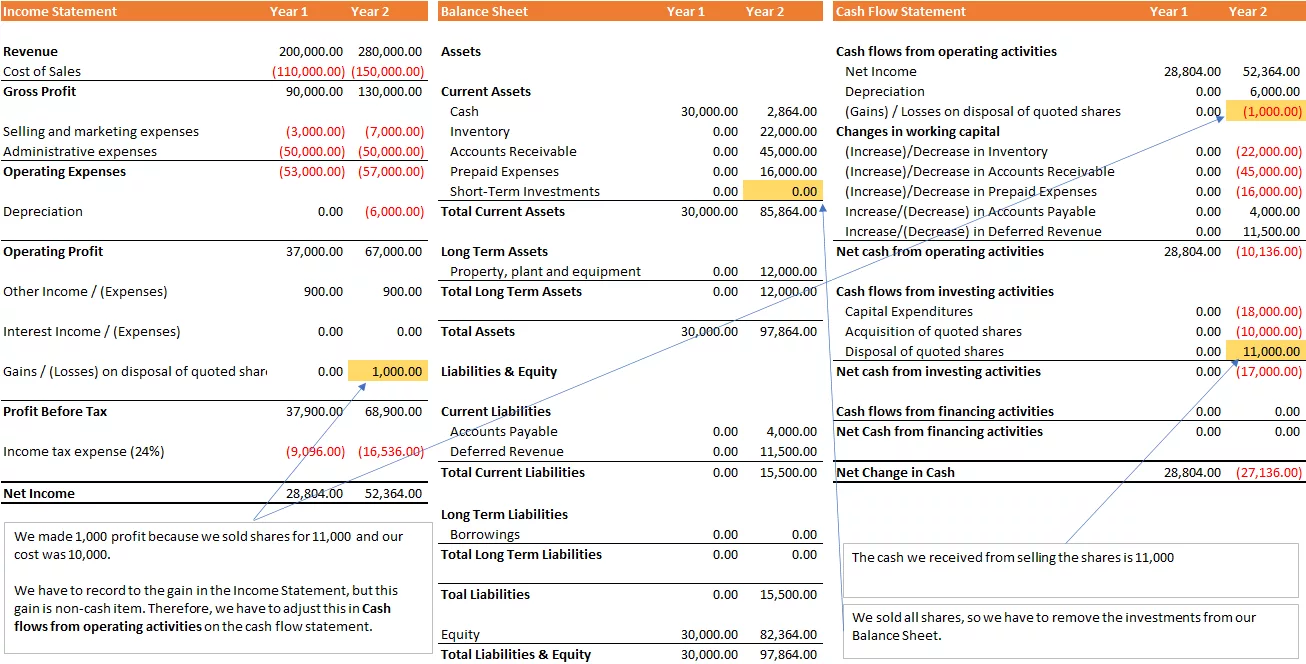

Selling Assets or Investments with Loss

If we disposed the shares for $9,000 with $1,000 loss, we apply the same logic like “Selling Assets or Investments with Gain“. We add the loss of $1,000 in the Cash Flows from Operating Activities section, and then subtract the loss and show the book value of the Assets sold in the Cash Flows from Investing Activities section, so $9,000 appears there.

| Income Statement | Year 1 | Year 2 |

| Revenue | 200,000.00 | 280,000.00 |

| Cost of Sales | (110,000.00) | (150,000.00) |

| Gross Profit | 90,000.00 | 130,000.00 |

| Selling and marketing expenses | (3,000.00) | (7,000.00) |

| Administrative expenses | (50,000.00) | (50,000.00) |

| Operating Expenses | (53,000.00) | (57,000.00) |

| Depreciation | 0.00 | (6,000.00) |

| Operating Profit | 37,000.00 | 67,000.00 |

| Other Income / (Expenses) | 900.00 | 900.00 |

| Interest Income / (Expenses) | 0.00 | 0.00 |

| Gains / (Losses) on disposal of quoted shares | 0.00 | (1,000.00) |

| Profit Before Tax | 37,900.00 | 66,900.00 |

| Income tax expense (24%) | (9,096.00) | (16,056.00) |

| Net Income | 28,804.00 | 50,844.00 |

| Cash Flow Statement | Year 1 | Year 2 |

| Cash flows from operating activities | ||

| Net Income | 28,804.00 | 50,844.00 |

| Depreciation | 0.00 | 6,000.00 |

| (Gains) / Losses on disposal of quoted shares | 0.00 | 1,000.00 |

| Changes in working capital | ||

| (Increase)/Decrease in Inventory | 0.00 | (22,000.00) |

| (Increase)/Decrease in Accounts Receivable | 0.00 | (45,000.00) |

| (Increase)/Decrease in Prepaid Expenses | 0.00 | (16,000.00) |

| Increase/(Decrease) in Accounts Payable | 0.00 | 4,000.00 |

| Increase/(Decrease) in Deferred Revenue | 0.00 | 11,500.00 |

| Net cash from operating activities | 28,804.00 | (9,656.00) |

| Cash flows from investing activities | ||

| Capital Expenditures | 0.00 | (18,000.00) |

| Acquisition of quoted shares | 0.00 | (10,000.00) |

| Disposal of quoted shares | 0.00 | 9,000.00 |

| Net cash from investing activities | 0.00 | (19,000.00) |

| Cash flows from financing activities | 0.00 | 0.00 |

| Net Cash from financing activities | 0.00 | 0.00 |

| Net Change in Cash | 28,804.00 | (28,656.00) |

What Happens to our Balance Sheet?

Since we sold all of the shares, we must remove the investments from our Balance Sheet.

| Balance Sheet | Year 1 | Year 2 |

| Assets | ||

| Current Assets | ||

| Cash | 30,000.00 | 2,864.00 |

| Inventory | 0.00 | 22,000.00 |

| Accounts Receivable | 0.00 | 45,000.00 |

| Prepaid Expenses | 0.00 | 16,000.00 |

| Short-Term Investments | 0.00 | 0.00 |

| Total Current Assets | 30,000.00 | 85,864.00 |

| Long Term Assets | ||

| Property, plant and equipment | 0.00 | 12,000.00 |

| Total Long Term Assets | 0.00 | 12,000.00 |

| Total Assets | 30,000.00 | 97,864.00 |

| Liabilities & Equity | ||

| Current Liabilities | ||

| Accounts Payable | 0.00 | 4,000.00 |

| Deferred Revenue | 0.00 | 11,500.00 |

| Total Current Liabilities | 0.00 | 15,500.00 |

| Long Term Liabilities | ||

| Borrowings | 0.00 | 0.00 |

| Total Long Term Liabilities | 0.00 | 0.00 |

| Toal Liabilities | 0.00 | 15,500.00 |

| Equity | 30,000.00 | 82,364.00 |

| Total Liabilities & Equity | 30,000.00 | 97,864.00 |

Impact of Selling Assets or Investments (Gains) to the Financial Statements in a Glance

Impact of Selling Assets or Investments (Losses) to the Financial Statements in a Glance