Raising Debt

When a company raises debt, the transaction appears only in the Cash Flows from Financing Activities section because it doesn’t affect the company’s taxes. When the company repays debt principal, the repayment appears only in the Cash Flows from Financing Activities section.

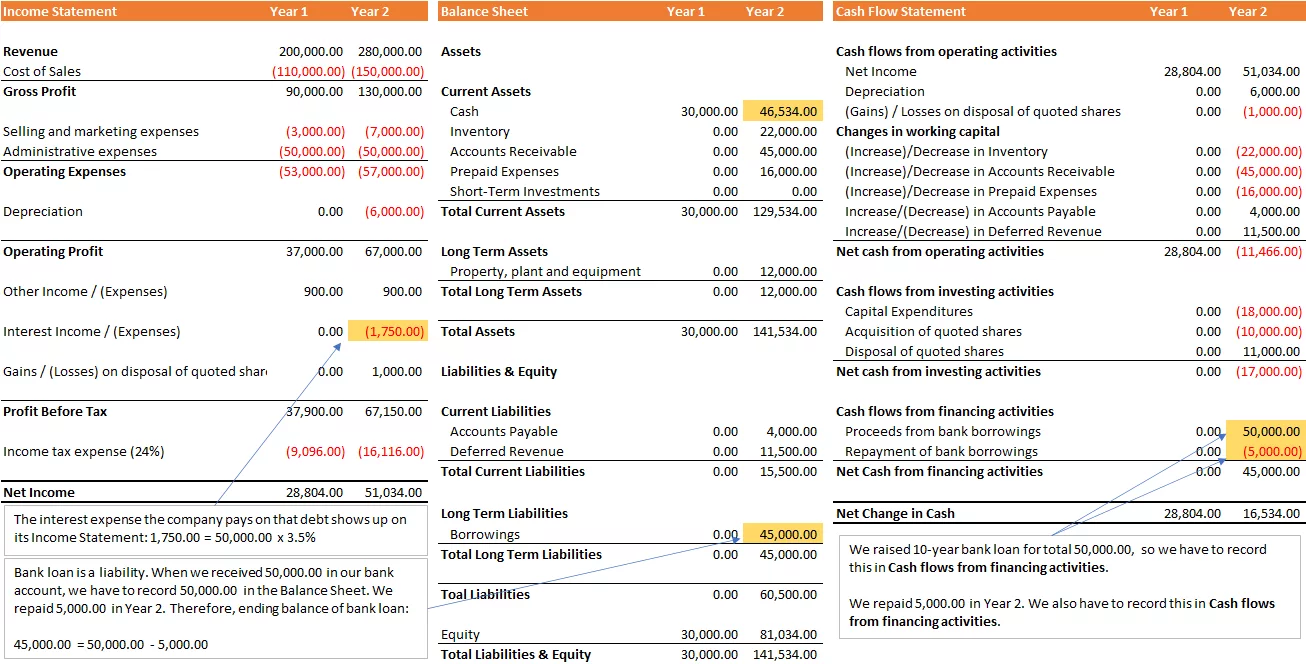

However, the interest expense that the company pays on that debt is reported in the Income Statement because the interest expense affects the company’s taxes.

Taking on debt increases the company’s cash balance. Think about what happens when you take out a student loan: You’ve to pay it back in the future, but right now you’ve more cash to pay tuition.

To sustain business growth of our business, we raised 10-year bank loan for total $50,000.00. We will repay $5,000.00 the debt every year, and the bank will charge us 3.5% interest rate per annum.

We raised 10-year bank loan for total 50,000.00, so we must record this in Cash flows from financing activities. We repaid 5,000.00 in Year 2. We also have to record this in Cash flows from financing activities.

| Cash Flow Statement | Year 1 | Year 2 |

| Cash flows from operating activities | ||

| Net Income | 28,804.00 | 51,034.00 |

| Depreciation | 0.00 | 6,000.00 |

| (Gains) / Losses on disposal of quoted shares | 0.00 | (1,000.00) |

| Changes in working capital | ||

| (Increase)/Decrease in Inventory | 0.00 | (22,000.00) |

| (Increase)/Decrease in Accounts Receivable | 0.00 | (45,000.00) |

| (Increase)/Decrease in Prepaid Expenses | 0.00 | (16,000.00) |

| Increase/(Decrease) in Accounts Payable | 0.00 | 4,000.00 |

| Increase/(Decrease) in Deferred Revenue | 0.00 | 11,500.00 |

| Net cash from operating activities | 28,804.00 | (11,466.00) |

| Cash flows from investing activities | ||

| Capital Expenditures | 0.00 | (18,000.00) |

| Acquisition of quoted shares | 0.00 | (10,000.00) |

| Disposal of quoted shares | 0.00 | 11,000.00 |

| Net cash from investing activities | 0.00 | (17,000.00) |

| Cash flows from financing activities | ||

| Proceeds from bank borrowings | 0.00 | 50,000.00 |

| Repayment of bank borrowings | 0.00 | (5,000.00) |

| Net Cash from financing activities | 0.00 | 45,000.00 |

| Net Change in Cash | 28,804.00 | 16,534.00 |

Bank loan is a liability. When we received $50,000.00 in our bank account, we have to record $50,000.00 in the Balance Sheet. We repaid $5,000.00 in Year 2. Therefore, ending balance of bank loan: $45,000.00 = $50,000.00 – $5,000.00.

| Balance Sheet | Year 1 | Year 2 |

| Assets | ||

| Current Assets | ||

| Cash | 30,000.00 | 46,534.00 |

| Inventory | 0.00 | 22,000.00 |

| Accounts Receivable | 0.00 | 45,000.00 |

| Prepaid Expenses | 0.00 | 16,000.00 |

| Short-Term Investments | 0.00 | 0.00 |

| Total Current Assets | 30,000.00 | 129,534.00 |

| Long Term Assets | ||

| Property, plant and equipment | 0.00 | 12,000.00 |

| Total Long Term Assets | 0.00 | 12,000.00 |

| Total Assets | 30,000.00 | 141,534.00 |

| Liabilities & Equity | ||

| Current Liabilities | ||

| Accounts Payable | 0.00 | 4,000.00 |

| Deferred Revenue | 0.00 | 11,500.00 |

| Total Current Liabilities | 0.00 | 15,500.00 |

| Long Term Liabilities | ||

| Borrowings | 0.00 | 45,000.00 |

| Total Long Term Liabilities | 0.00 | 45,000.00 |

| Toal Liabilities | 0.00 | 60,500.00 |

| Equity | 30,000.00 | 81,034.00 |

| Total Liabilities & Equity | 30,000.00 | 141,534.00 |

The interest expense we paid on that debt shows up on its Income Statement: $1,750.00 = $50,000.00 x 3.5%.

| Income Statement | Year 1 | Year 2 |

| Revenue | 200,000.00 | 280,000.00 |

| Cost of Sales | (110,000.00) | (150,000.00) |

| Gross Profit | 90,000.00 | 130,000.00 |

| Selling and marketing expenses | (3,000.00) | (7,000.00) |

| Administrative expenses | (50,000.00) | (50,000.00) |

| Operating Expenses | (53,000.00) | (57,000.00) |

| Depreciation | 0.00 | (6,000.00) |

| Operating Profit | 37,000.00 | 67,000.00 |

| Other Income / (Expenses) | 900.00 | 900.00 |

| Interest Income / (Expenses) | 0.00 | (1,750.00) |

| Gains / (Losses) on disposal of quoted shares | 0.00 | 1,000.00 |

| Profit Before Tax | 37,900.00 | 67,150.00 |

| Income tax expense (24%) | (9,096.00) | (16,116.00) |

| Net Income | 28,804.00 | 51,034.00 |

Impact of Raising Debt to the Financial Statements in a Glance