Dividends

Dividends are cash payments to equity investors. For example, if you buy a share of a company’s stock for $10.00, the company could pay you a dividend of $0.30 in the future. Dividends do not affect a company’s taxes, so they do not show up on the Income Statement. In the Cash Flow Statement, dividends appear as a negative item in Cash Flows from Financing Activities. Dividends therefore reduce cash balance and equity.

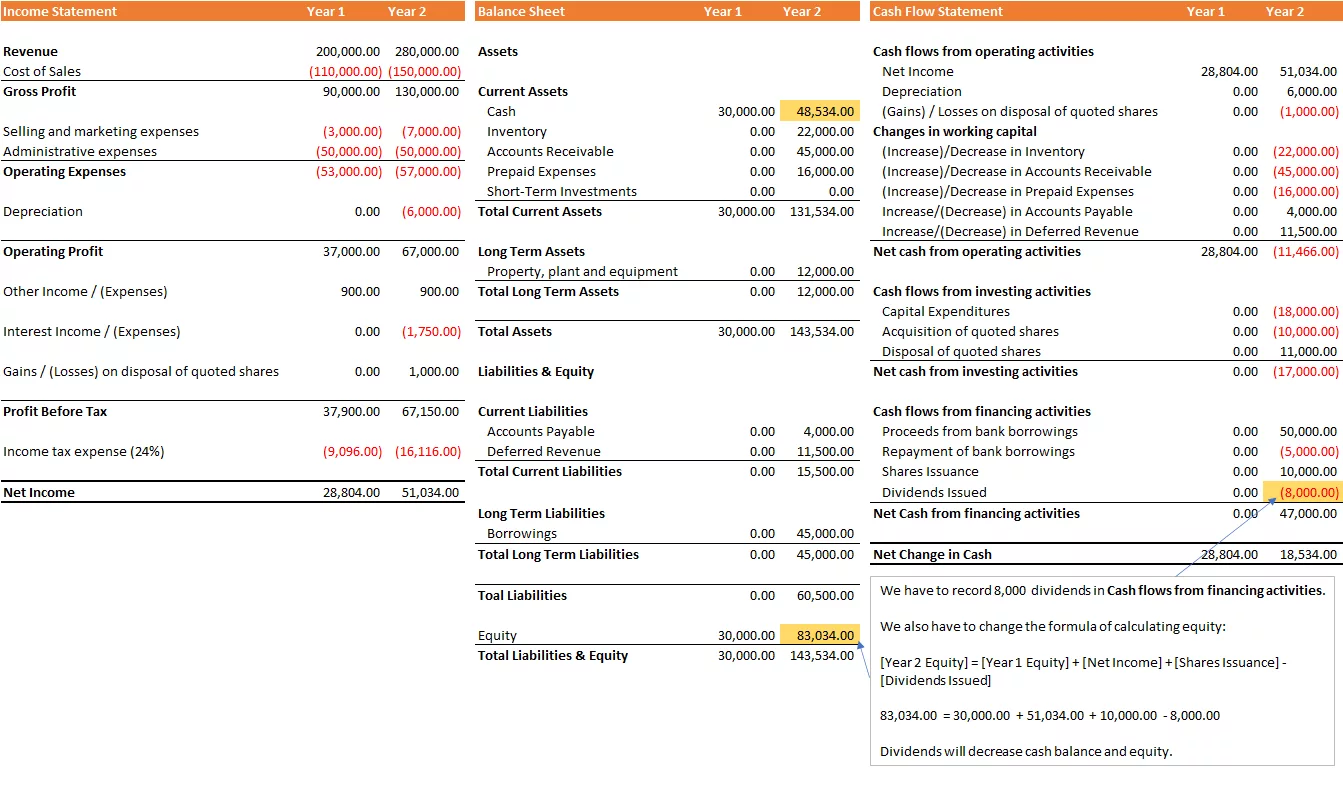

For the case of “Organic Food Everyday”, we issued $8,000.00 dividends to the founders. We must record $8,000 dividends in the Cash flows from financing activities section.

| Cash Flow Statement | Year 1 | Year 2 |

| Cash flows from operating activities | ||

| Net Income | 28,804.00 | 51,034.00 |

| Depreciation | 0.00 | 6,000.00 |

| (Gains) / Losses on disposal of quoted shares | 0.00 | (1,000.00) |

| Changes in working capital | ||

| (Increase)/Decrease in Inventory | 0.00 | (22,000.00) |

| (Increase)/Decrease in Accounts Receivable | 0.00 | (45,000.00) |

| (Increase)/Decrease in Prepaid Expenses | 0.00 | (16,000.00) |

| Increase/(Decrease) in Accounts Payable | 0.00 | 4,000.00 |

| Increase/(Decrease) in Deferred Revenue | 0.00 | 11,500.00 |

| Net cash from operating activities | 28,804.00 | (11,466.00) |

| Cash flows from investing activities | ||

| Capital Expenditures | 0.00 | (18,000.00) |

| Acquisition of quoted shares | 0.00 | (10,000.00) |

| Disposal of quoted shares | 0.00 | 11,000.00 |

| Net cash from investing activities | 0.00 | (17,000.00) |

| Cash flows from financing activities | ||

| Proceeds from bank borrowings | 0.00 | 50,000.00 |

| Repayment of bank borrowings | 0.00 | (5,000.00) |

| Shares Issuance | 0.00 | 10,000.00 |

| Dividends Issued | 0.00 | (8,000.00) |

| Net Cash from financing activities | 0.00 | 47,000.00 |

| Net Change in Cash | 28,804.00 | 18,534.00 |

Paying dividends will reduce Equity and Cash Balance in the Balance Sheet.

| Balance Sheet | Year 1 | Year 2 | Explanation |

|---|---|---|---|

| Assets | |||

| Current Assets | |||

| Cash | 30,000.00 | 48,534.00 | |

| Inventory | 0.00 | 22,000.00 | |

| Accounts Receivable | 0.00 | 45,000.00 | |

| Prepaid Expenses | 0.00 | 16,000.00 | |

| Short-Term Investments | 0.00 | 0.00 | |

| Total Current Assets | 30,000.00 | 131,534.00 | |

| Long Term Assets | |||

| Property, plant and equipment | 0.00 | 12,000.00 | |

| Total Long Term Assets | 0.00 | 12,000.00 | |

| Total Assets | 30,000.00 | 143,534.00 | |

| Liabilities & Equity | |||

| Current Liabilities | |||

| Accounts Payable | 0.00 | 4,000.00 | |

| Deferred Revenue | 0.00 | 11,500.00 | |

| Total Current Liabilities | 0.00 | 15,500.00 | |

| Long Term Liabilities | |||

| Borrowings | 0.00 | 45,000.00 | |

| Total Long Term Liabilities | 0.00 | 45,000.00 | |

| Toal Liabilities | 0.00 | 60,500.00 | |

| Equity | 30,000.00 | 83,034.00 | We also have to change the formula of calculating equity: [Year 2 Equity] = [Year 1 Equity] + [Net Income] + [Shares Issuance] – [Dividends Issued] 83,034.00 = 30,000.00 + 51,034.00 + 10,000.00 – 8,000.00 Dividends will decrease cash balance and equity. |

| Total Liabilities & Equity | 30,000.00 | 143,534.00 |

Impact of Dividends Paid to the Financial Statements in a Glance