How do short positions in securities trading work?

In general, there are two types of securities trading you can observe in commercial banks: Trading Assets and Trading Liabilities. What are Trading Assets and Trading Liabilities? In short,

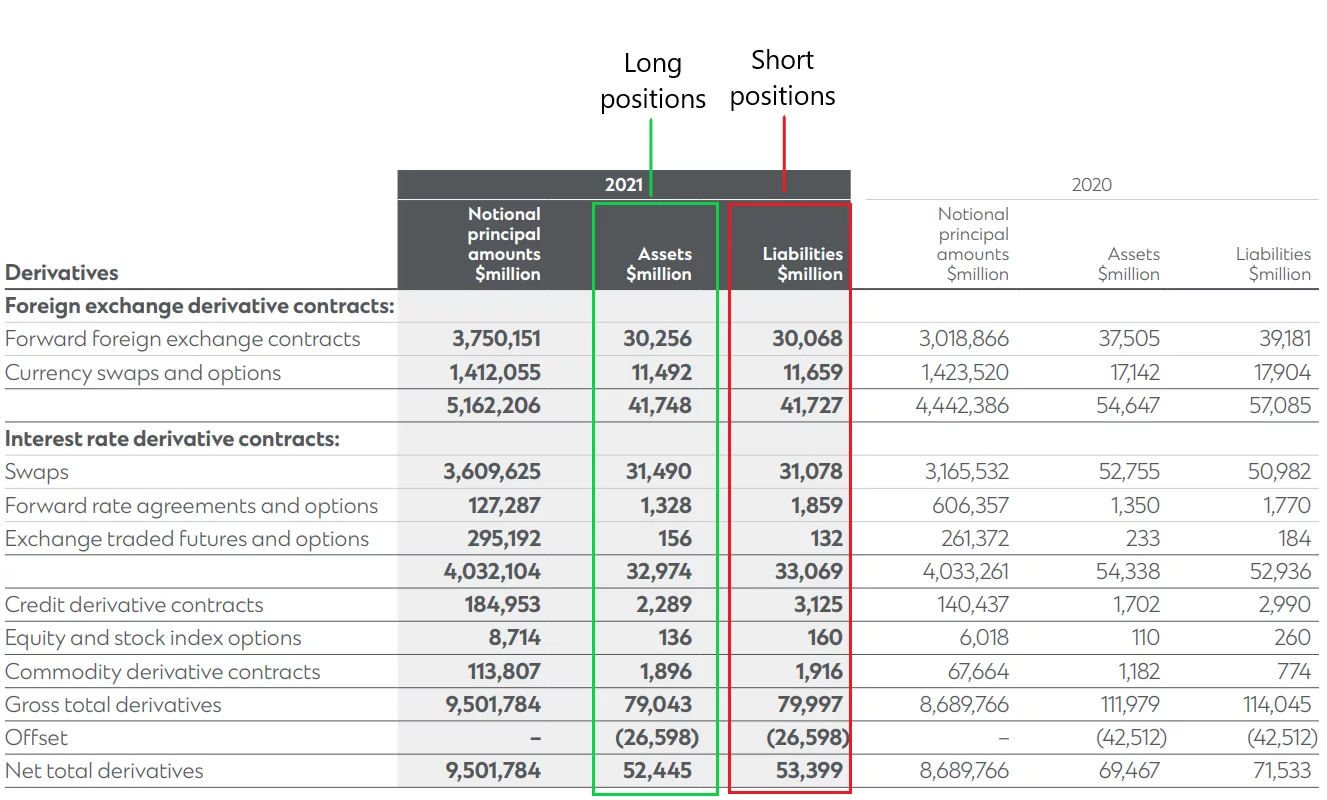

- Trading Assets – Long positions taken in derivatives

- Trading Liabilities – Short positions taken in derivatives

The following shows how Standard Chartered PLC classified their long positions and short positions in their Balance Sheet.

Concept of long positions is simple: a bank buys a security or derivative with the expectation that it will rise in value. The long position is not the focus of this article.

Short Positions

The short position is a technique used when a bank anticipates that the value of a security or derivative will decrease in the short term. In a short sell transaction, the bank borrows the shares of stock from a investment firm to sell to another investor. Concept sound simple, but the process is complicated in reality. The difference between the sale price and the lower purchase price is the profit, minus any borrowing fees or interest paid for using someone else’s shares. If the price of the security instead rises, the bank incurs a loss, potentially unlimited.

Here, I do my best to explain how a short position take place in layman’s term. There are five steps to create and subsequently close out a short position:

Step 1 – Borrow security

Let say a bank wants to short sell a security. To do so, the bank must lend the security from a security lender (such as pension fund) at 100% of market value. The bank must give cash collateral of 105% of market value to the security lender.

Assume price of the security is $1.00 per unit and the bank lend 100 units from the security lender.

Market value of security lent = 100 units x $1.00 = $100

Cash collateral: $100 x 105% = $105.

Step 2 – Sell security

The bank sells $100 worth of security to Market Counterparty A, and the bank receives $100 cash from Market Counterparty A.

Step 3 – Pay/receive variation margin

Now, price of the security falls to $0.90. Here comes the concept of variation margin.

According to Investopedia, the variation margin is a variable margin payment made by clearing members, such as a futures broker, to their respective clearing houses based on adverse price movements of the futures contracts these members hold. Variation margin is paid by clearing members on a daily or intraday basis to reduce the exposure created by carrying high risk positions. Variation margin is different from initial margin.

In this case, the value of variation margin is -$10.5. The calculation is $90 – $105 = -$10.5.

Step 4 – Repurchase security

The bank can’t lend the security of the security lender forever. The bank must return the lent security to the security lender, but the bank sold 100 units of security to Market Counterparty A at $100 value.

Thus, the bank repurchases 100 units of the security at $0.90 per unit from Market Counterparty B.

Step 5 – Unwind security borrowing

The bank returns 100 units of the security at $0.90 per unit to the security lender. Then, the bank receives $94.5 from the security lender.

How to get $94.5?

Cash collateral – variation margin = $105 – $10.5 = MIN($94.5, $105).

Risks of short positions

Credit risk of the security lender

When lenders receive cash collateral, they reinvest it to generate additional yield. Cash is the most favoured form of collateral and is often invested in liquid assets, such as money market funds, repurchase agreements and deposits. Lenders could be exposed to hidden risks if the reinvestment strategy is aggressive, and the collateral is invested in volatile and/or illiquid assets. These risks should be monitored closely.

Market risk of the security

What if prices of the security trend against the bank’s position? What’s actual quality of the security? Refer to “Analyse Asset Quality of Commercial Banks“, you should consider:

- Management: Risk appetite and controls

- Credit risk: Issuer and counterparty exposure

- Disclosure: Risk profile of assets, liabilities and off balance sheet

- Market risk: Value at risk (VaR) modeling capability