How do repurchase agreement and reverse repurchase agreement work?

According to IMF, a repurchase agreement (repo, also known as “Obligations on securities sold under repurchase agreements“) is a transaction in which the borrower temporarily lends a security to the lender for cash with an agreement to buy it back in the future at a pre-determined price. Ownership of the security does not change hands in a repo transaction.

Repo is used to absorb liquidity from the banking system, for tenure ranging from overnight to 1 year. Apart from absorbing liquidity, repo transactions are also used for the purpose of lending specific securities requested by financial institutions to enhance secondary market liquidity in the bond market.

Meanwhile, a reverse repurchase agreement (Reverse Repo) is where the Bank buys eligible securities from banks, and at the same time and as part of the same operation, commits to resell the equivalent securities on a specified date at a specified price which reflects the repo rate. In many countries, the repo rate (the rate paid by the borrower in a repo transaction) is the benchmark rate for central bank lending. The Bank uses reverse repo transactions to provide liquidity to the banking institutions, including lending operations under standing facilities.

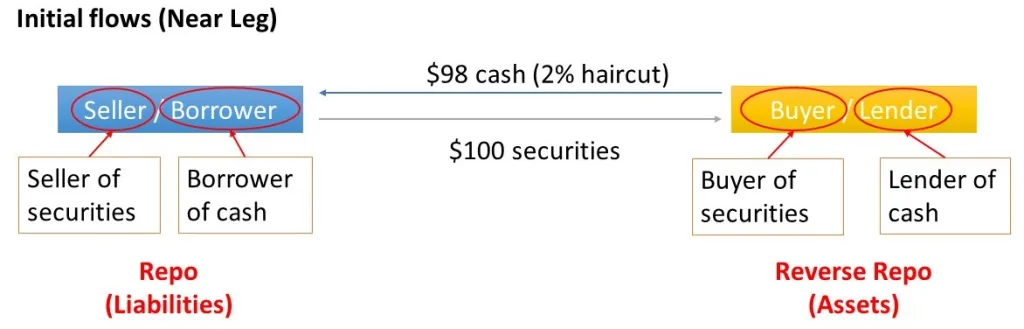

In Balance Sheet, reverse repurchase agreements are classified as Assets, and repurchase agreements are classified as Liabilities.

In Malaysia, banks utilise Reverse Repo on low-risk investments, such as Malaysian Government Securities, Malaysian Government Investment Issues and Foreign government treasury bills. Bank Negara Malaysia regulated how banks utilise Repurchase Agreements.

Investopedia and Robinhood provides very detailed explanation about Repo. Here, I do my best to explain Repo in layman’s terms.

Repurchase Agreement – Initial flow (Near Leg)

‘Leg’ is a term that is commonly used in reference to repurchase agreements. The near leg of the deal is the start of the agreement, when one party sells the security to the other.

Robinhood

Take the following illustration as example. The borrower of cash owns $100 securities and looking for short-term funding. The borrower (or seller) sells $100 securities to a buyer of securities. The buyer (or lender of cash) will pay $98 cash with 2% haircut to the seller (or the borrower).

In this case, the borrower of cash will classify this transaction as Repurchase Agreement, a liability in its Balance Sheet. The lender of cash will classify this transaction as Reverse Repurchase Agreement, an asset in its Balance Sheet.

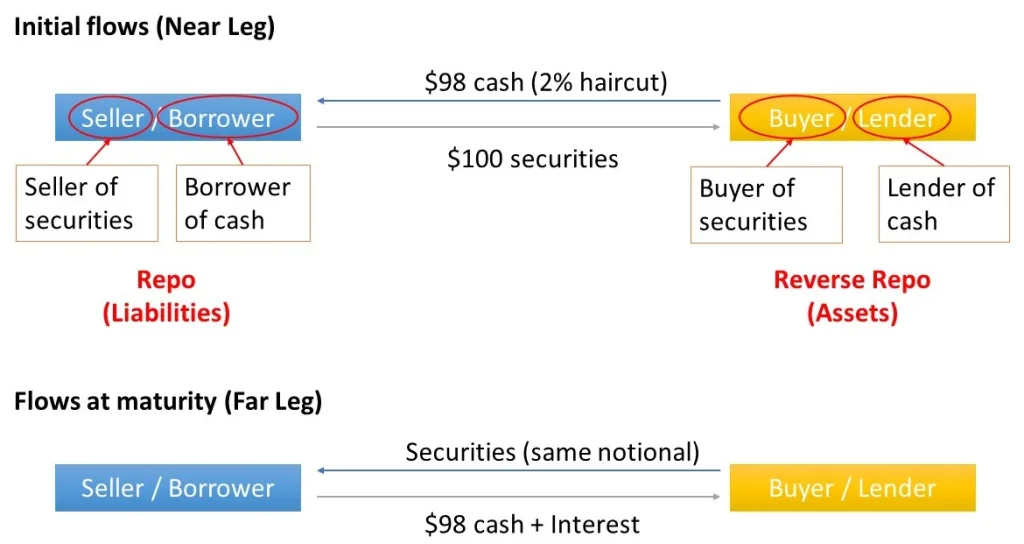

Repurchase Agreement – Flows at maturity (far leg)

The far leg of the deal is the maturity date, when the seller repurchases the security.

Robinhood

At maturity, the lender of cash returns securities to the borrower of cash in same notional. At the same time, the borrower will repay $98 cash plus interest (Repo Rate) to the lender.

Risks of Repurchase Agreement

There is no such thing as a riskless financial instrument. But repo can achieve a substantial reduction in the credit and liquidity risks of lending, if managed prudently.

- Collateralisation does not change the probability of default of a counterparty, so collateral taken from risky counterparties is more likely to be tested by a default and may turn out to be worth less than expected due to fluctuations in price, the impact of liquidation, and possible legal and operational problems. Consequently, collateral should be treated only as insurance against the default of the seller, not as a simple substitute for his credit risk.

- Although counterparty credit risk is the primary exposure in a repo, the choice of collateral is still very important.

- The credit risk on the collateral should have a minimal correlation with the credit risk on the repo counterparty (ie low wrong-way risk) in order to diversify credit exposure as much as possible.

- Collateral should have minimal credit and liquidity risks, in order to maximise certainty about its value and ease of liquidation in the event of a default. Government bonds have traditionally provided collateral that can best meet both criteria.

- Even the best asset is no good as collateral if it cannot be easily and securely transferred to a counterparty.

- Efficient collateral management is mainly about frequent and accurate calling for variation margin to compensate for fluctuations in the value of collateral.