Analyse Funding and Liquidity of Commercial Banks

As part of series of “Analyse Performance of Commercial Banks“, this article focus on the first area of FACE: Funding and Liquidity.

FACE stands for:

Why does analysing funding and liquidity of commercial banks so important?

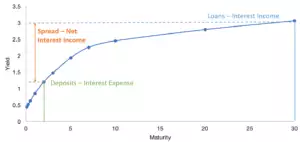

Banks add value and earn money from two main activities that are in compassed by their lending and depositing activities. Thus, there’s a maturity transformation here, and this is how and why banks generate value. Due to maturity transformation, banks must ensure adequate liquidity to match their liabilities.

As investor, we must look at how much loans and deposits of a bank are growing by and what are taking up those loans and deposits, such as, industry, geography, etc; how liquid are the bank’s Assets and Liabilities? Can it get money on short notice to cover mass withdrawals / other disasters?

In short, we must analyse a bank’s ability to sustain its liquidity position and the stability of its funding. The core metric, loans/customer deposits, has the greatest explanatory power for the funding & liquidity factor score because it is the single best indicator of the matching of a bank’s assets and funding, and hence of the potential vulnerability of its liquidity.

Click to learn “How do commercial banks raise cash and how quickly?“; Examples of analysis commercial banks: Malayan Banking Berhad (MAYBANK) and Public Bank Berhad (PBBANK). Want to test your knowledge of earnings ratios of banks, click here to take a test.

Core Metric: Loans/Customer Deposits (%)

[Gross Loans]/[Customer Deposits] ×100%

The numerator and denominator exclude loans and deposits with other banks and repos, but all other loans and deposits are included. In the numerator, loans are gross of loan loss reserves.

What does Loans/Customer Deposits (%) tell us?

The loans/deposits ratio can provide an overview as to what extent a bank, whose assets are dominated by, or which has a sizeable, loan portfolio, is dependent on more credit-sensitive wholesale funding. It tells us to what extent customer deposits, which are generally regarded as a cheap, stable, and core funding source, do not fully fund lending. This means the bank has to access more expensive market (or wholesale) funding, which can be very credit and/or confidence sensitive.

There is no benchmark of this ratio. Observing the trend of ratios and doing peer comparison is very important.

If the ratio is very high (such as > 90% or industry average, for the sake of example),

- “Bank run” will cause huge trouble to the bank especially when interbank deposits is very high too.

- The bank will have to increase customer deposits to increase lending

- The bank will have to access more expensive market or wholesale funding to increase lending.

If the ratio is low (< industry average),

- The bank may not fully utilise customer deposits to increase lending. From another perspective, the bank still has room to grow.

- The bank may put higher focus on fee and commission business, and trading activities. You have to perform analysis on income composition of the bank.

To improve the ratio, the bank can raise deposit funding, limit loan growth, and acquire other bank with deposit base. This ratio can be distorted by securitisation and classification of interbank or “hot money” as customer deposits.

Complementary Metric: Customer Deposits/Total Funding (%)

[Customer Deposits]/[Total Funding] ×100%

[Total Funding]=[Total Liabilities]-[Derivative Financial Liabilities]-[Other Non Funding Liabilities]-[Provision for Taxation]-[Deferred Tax Liabilities]-[Insurance Liabilities]

The numerator is the same as the denominator in the core metric for funding and liquidity. The denominator is all funding. It includes customer funding, interbank funding, repos and other short-term and money market funding, all debt funding, including vanilla subordinated debt and hybrid securities. Trading liabilities (“short” trades) are included in the denominator but derivatives are not. The denominator does not include equity or non-funding liabilities, such as pension reserves, tax liabilities and insurance liabilities.

What does Customer Deposits/Total Funding (%) tell us?

This ratio provides simple analysis of funding composition. If the ratio is high, this tells us that large portion of funding is from customer deposits, which is more stable. Low ratio indicates majority funding of the bank was from more expensive and more volatile instruments.

There is no benchmark of this ratio. Observing the trend of ratios and doing peer comparison is very important.

Oher useful ratios and metrics that useful to deep dive into warning signals in funding and liquidity of banks

| Funding and Liquidity | Ratio and Calculation | Meaning | Ways to Improve Ratio | Ratio Distortions |

|---|---|---|---|---|

| Liability-side volatility and the resultant liquidity risk | Market Funds / Tangible Banking Assets Tangible Banking Assets = Total Assets minus Goodwill and Other Intangibles minus Insurance Assets | The proportion of the balance sheet that credit-sensitive investors and counterparties fund | Raise deposit funding | Securitisation Defining illiquid or volatile trading assets as liquid |

| Interbank ratio | Interbank placings / Interbank deposits received | Low figure less than 100% indicates overdependence on volatile interbank funding | Access other sources of funding, such as customer deposits and long-term debt | Can be distorted if truly little interbank market relative to balance sheet of banks. |

| Liquidity of balance sheet | Liquid assets / Total Assets (includes cash interbank placings, government paper and trading assets) | What percentage of assets can be easily turned into cash without loss | Restrict loan growth and investments | Defining illiquid or volatile trading assets as liquid |

| Liquidity run off ratio | Liquid assets / Short term funding and deposits | What percentage of short-term liabilities can be met by liquid assets in a crisis without loss | Restrict growth of illiquid assets | Defining illiquid or volatile trading assets as liquid |

- Liquid Assets consist of Cash and Balances with Central Bank, Due from Other Financial Institutions, Trading securities, Available-for-Sale Securities, Other Securities, and Unearned Income from Securities.

- Market Funds: Due to Financial Institutions + Short-term borrowings + Trading Liabilities + Other Financial Liabilities at Fair Value + Senior Bonds + Due to Related Parties – 50% * Covered Bonds