Special Purpose Entity / Vehicle (SPE / SPV)

Before you continue reading, I strongly recommend you read through this article published in 2002: "Special-Purpose Entities Are Often A Clever Way to Raise Debt Levels". This article completely concluded key issues of companies misusing "Special Purpose Entities".

What is Special Purpose Entity / Vehicle?

SPE is created by a parent company to accomplish a narrow and well-defined objective. The reasons for setting up an SPE are to:

- Hold a pool of assets to act as security (collateral) for loans

- Pass the financial risks associated with holding a pool of assets to other entities or investor(s)

- Avail of favourable tax circumstances

- Create liquidity for an entity i.e. give it easier access to cash.

SPEs often have little or no physical presence, such as an office or full-time employees. They are also often part of complex chains of companies across several different countries.

If you prefer to learn a more structured definition, feel free to read “Special Purpose Entities: Guidelines for a Data Template“.

The definition of an SPE by IMF

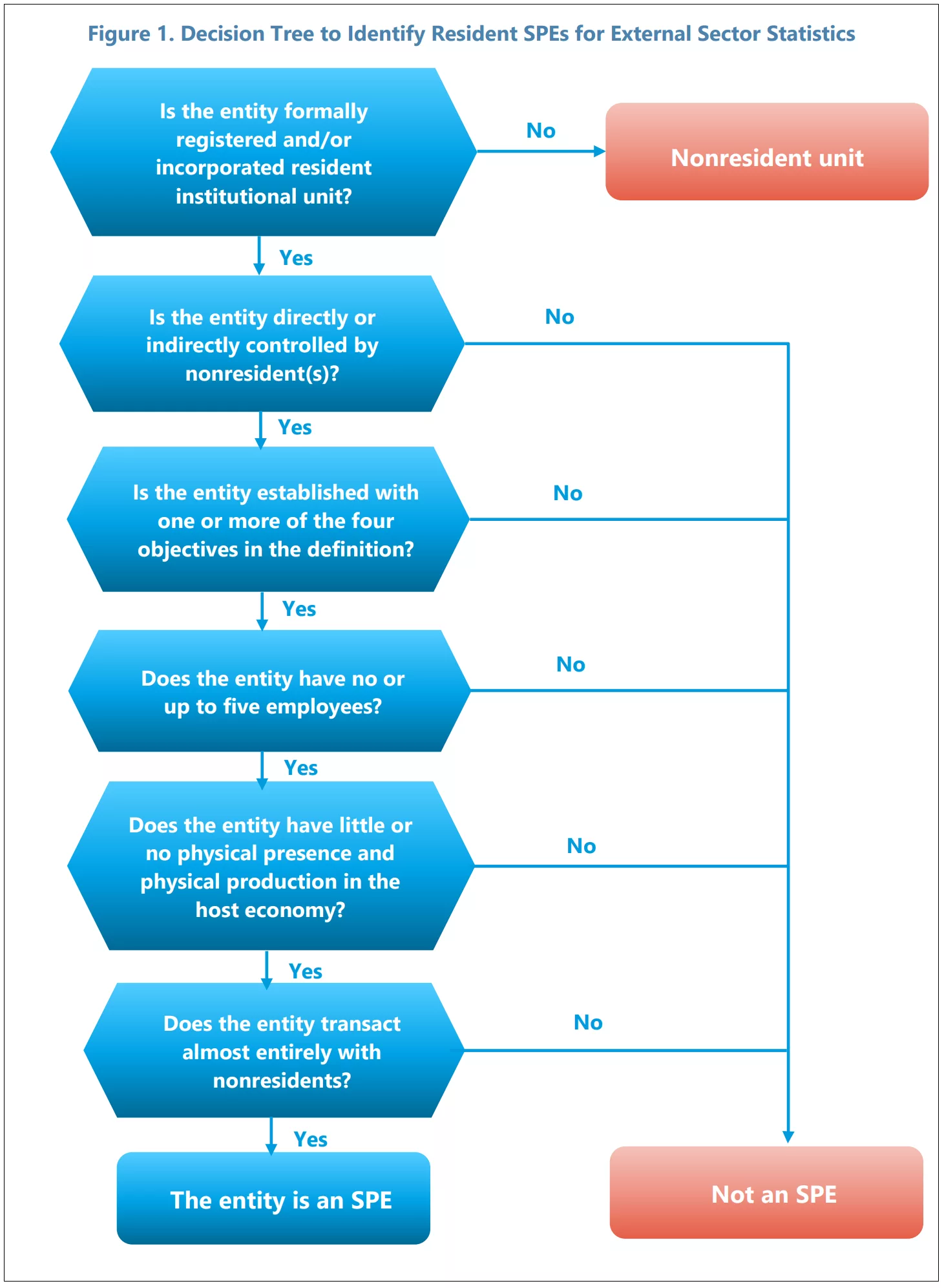

- An SPE, resident in an economy, is a formally registered and/or incorporated legal entity recognized as an institutional unit, with no or little employment up to a maximum of five employees, no or little physical presence and no or little physical production in the host economy.

- SPEs are directly or indirectly controlled by nonresidents.

- SPEs are established to obtain specific advantages provided by the host jurisdiction with an objective to (i) grant its owner(s) access to capital markets or sophisticated financial services; and/or (ii) isolate owner(s) from financial risks; and/or (iii) reduce regulatory and tax burden; and/or (iv) safeguard confidentiality of their transactions and owner(s).

- SPEs transact almost entirely with nonresidents and a large part of their financial balance sheet typically consists of cross-border claims and liabilities.

Decision Tree to Identify Resident SPEs by IMF

A SPE has Sponsor and Capital Provider:

- Sponsor: Entity on whose behalf the SPE was created. Often retains significant beneficial interest in the SPE’s activities, even though it may own little or none of the equity.

- Capital Provider: Provide funding to the SPE.

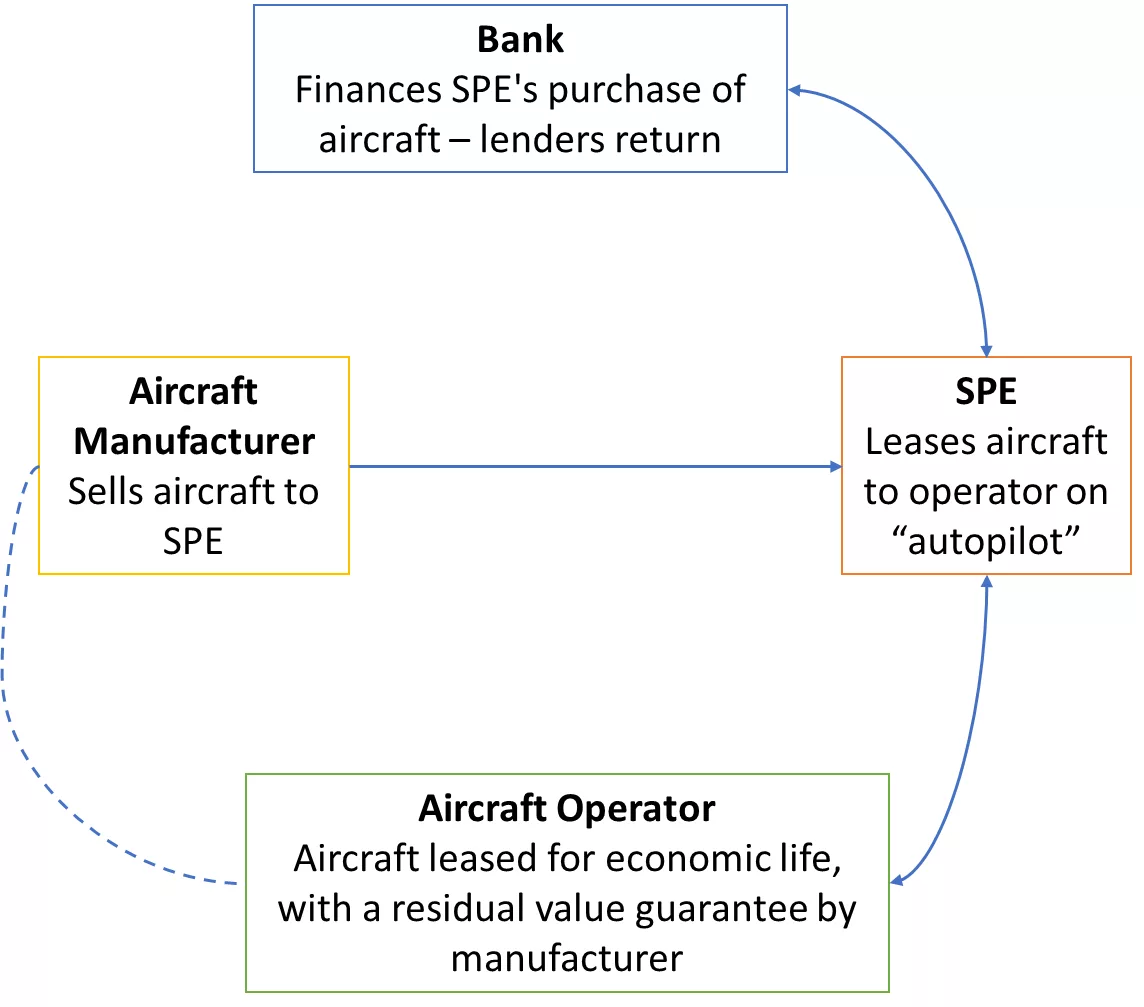

Let’s take aviation financing as example. Aircraft Operators (Sponsor) usually will create SPE where:

- One or more banks (Capital Provider) will provide loans to SPE to finance purchasing of aircraft.

- Aircraft Manufacturer will sell aircraft to the SPE.

- The SPE will lease aircraft to operator.

For example, Kenya Airways has leased 35 aircrafts comprising 18 (finance lease) and 17 (operating lease).

- Finance lease – Kenya Airways has two SPVS such as Tsavo and Samburu (refer Annual Report 2022 page 144) where they are long-term financial lease with an option to purchase aircraft at the end of the agreement.

- Operating lease – Kenya Airways deals with the following international renowned lessors; Dubai Aerospace Enterprise (DAE), AERCAP, Bank of China (BOC) Aviation, China Development Bank (CDB) Leasing, Deucalion, Macquarie, Aviation Capital Group (ACG), Goshawk, Nordic Aviation Capital (NAC), Azzora, Chorus Aviation, NAC and Montrose.

Click to learn more about aviation finance. Another interesting article: “When to Form a Special Purpose Entity in BizAv“

Uses of Special Purpose Entities

The following are the most common reasons for creating SPVs (Source: CFI – Special Purpose Vehicle (SPV)):

1. Risk sharing

A corporation’s project may entail significant risks. Creating an SPV enables the corporation to legally isolate the risks of the project and then share this risk with other investors.

2. Securitization

Securitization of loans is a common reason to create an SPV. For example, when issuing mortgage-backed securities from a pool of mortgages, a bank can separate the loans from its other obligations by creating an SPV. The SPV allows investors in the mortgage-backed securities to receive payments for these loans before other creditors of the bank.

3. Asset transfer

Certain types of assets can be hard to transfer. Thus, a company may create an SPV to own these assets. When they want to transfer the assets, they can simply sell the SPV as part of a merger and acquisition (M&A) process.

4. Property sale

If the taxes on property sales are higher than the capital gain realized from the sale, a company may create an SPV that will own the properties for sale. It can then sell the SPV instead of the properties and pay tax on the capital gain from the sale instead of having to pay the property sales tax.

Control of Special Purpose Entities

Entities need to analyse whether they have control of SPE and if so consolidate. Whoever controls should consolidate:

- On whose behalf was it set up/ does it perform activities?

- Who has most exposure to variable returns from the SPE?

- Determines the decision making (including autopilot)? (Click here to learn more about autopilot)