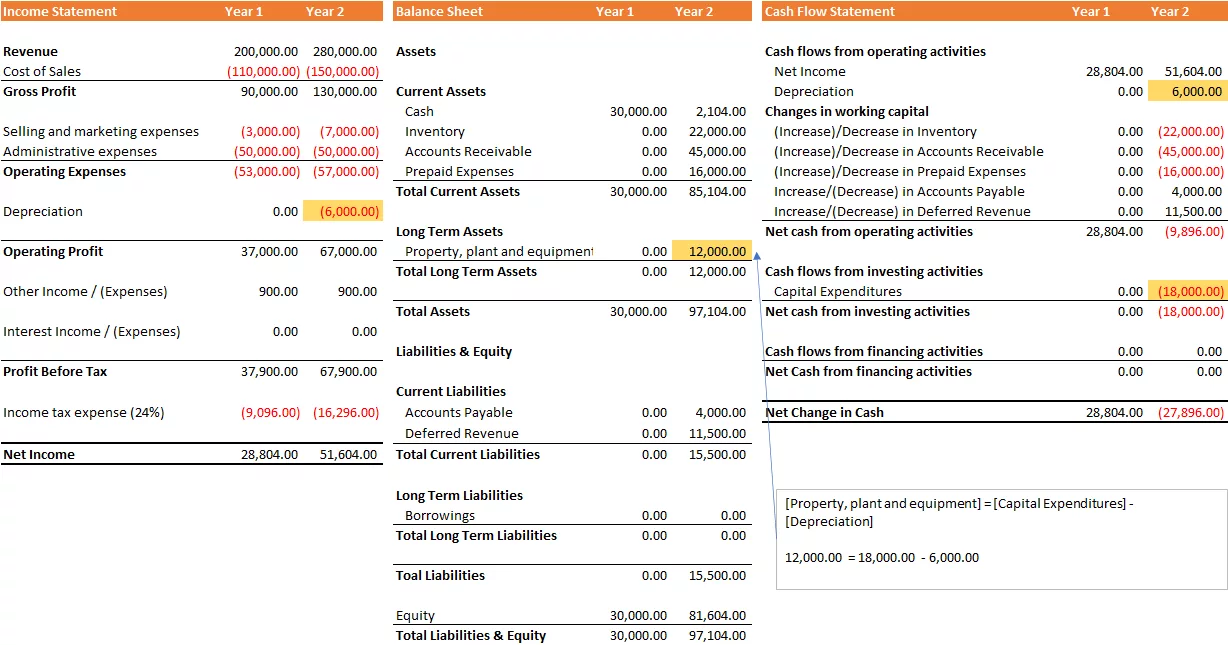

Capital Expenditures and Depreciation

This is a continuation of our business expansion to selling frozen foods in our store. We have purchased a large freezer to store frozen foods. Since this item is useful in the long term (more than 1 year), we initially record it only as Capital Expenditures in Cash Flows from Investing Activities on the Cash Flow Statement, and then allocate its cost over time as Depreciation in the Income Statement.

Let say we spend $18,000 on the freezer. Assume it will last 3 years (hopefully longer). We record a cash outflow of $18,000 in the Cash Flow Statement and a “Depreciation” of $6,000 in the Income Statement each year.

| Year 2 | Year 3 | Year 4 | |

|---|---|---|---|

| Capital Expenditures on Cash Flows from Investing Activities | 18,000 | ||

| Depreciation on the Income Statement | 6,000 | 6,000 | 6,000 |

| Book Value | 12,000 | 6,000 | 0 |

The freezer is a long-term asset (more than 1 year), so the freezer is recorded on the Balance Sheet as Property, plant and equipment with a carrying value of $12,000.

| Balance Sheet | Year 1 | Year 2 | Explanation |

|---|---|---|---|

| Assets | |||

| Current Assets | |||

| Cash | 30,000.00 | 2,104.00 | |

| Inventory | 0.00 | 22,000.00 | |

| Accounts Receivable | 0.00 | 45,000.00 | |

| Prepaid Expenses | 0.00 | 16,000.00 | |

| Total Current Assets | 30,000.00 | 85,104.00 | |

| Long Term Assets | |||

| Property, plant and equipment | 0.00 | 12,000.00 | [Property, plant and equipment] = [Capital Expenditures] – [Depreciation] 12,000.00 = 18,000.00 – 6,000.00 |

| Total Long Term Assets | 0.00 | 12,000.00 | |

| Total Assets | 30,000.00 | 97,104.00 | |

| Liabilities & Equity | |||

| Current Liabilities | |||

| Accounts Payable | 0.00 | 4,000.00 | |

| Deferred Revenue | 0.00 | 11,500.00 | |

| Total Current Liabilities | 0.00 | 15,500.00 | |

| Long Term Liabilities | |||

| Borrowings | 0.00 | 0.00 | |

| Total Long Term Liabilities | 0.00 | 0.00 | |

| Toal Liabilities | 0.00 | 15,500.00 | |

| Equity | 30,000.00 | 81,604.00 | |

| Total Liabilities & Equity | 30,000.00 | 97,104.00 |

Capital Expenditures cause cash flow to decrease initially. Net Income also decreases due to this Depreciation expense, but the Depreciation is not recorded until the first year after the Capital Expenditures, so there is no immediate impact.

| Income Statement | Year 1 | Year 2 |

| Revenue | 200,000.00 | 280,000.00 |

| Cost of Sales | (110,000.00) | (150,000.00) |

| Gross Profit | 90,000.00 | 130,000.00 |

| Selling and marketing expenses | (3,000.00) | (7,000.00) |

| Administrative expenses | (50,000.00) | (50,000.00) |

| Operating Expenses | (53,000.00) | (57,000.00) |

| Depreciation | 0.00 | (6,000.00) |

| Operating Profit | 37,000.00 | 67,000.00 |

| Other Income / (Expenses) | 900.00 | 900.00 |

| Interest Income / (Expenses) | 0.00 | 0.00 |

| Profit Before Tax | 37,900.00 | 67,900.00 |

| Income tax expense (24%) | (9,096.00) | (16,296.00) |

| Net Income | 28,804.00 | 51,604.00 |

It should also be noted that Depreciation is a non-cash expense, so it is an adjustment in the Cash Flow Statement. It reduces the company’s taxes, but it costs the company nothing in cash. As a result, the company’s cash balance increases.

| Cash Flow Statement | Year 1 | Year 2 |

| Cash flows from operating activities | ||

| Net Income | 28,804.00 | 51,604.00 |

| Depreciation | 0.00 | 6,000.00 |

| Changes in working capital | ||

| (Increase)/Decrease in Inventory | 0.00 | (22,000.00) |

| (Increase)/Decrease in Accounts Receivable | 0.00 | (45,000.00) |

| (Increase)/Decrease in Prepaid Expenses | 0.00 | (16,000.00) |

| Increase/(Decrease) in Accounts Payable | 0.00 | 4,000.00 |

| Increase/(Decrease) in Deferred Revenue | 0.00 | 11,500.00 |

| Net cash from operating activities | 28,804.00 | (9,896.00) |

| Cash flows from investing activities | ||

| Capital Expenditures | 0.00 | (18,000.00) |

| Net cash from investing activities | 0.00 | (18,000.00) |

| Cash flows from financing activities | 0.00 | 0.00 |

| Net Cash from financing activities | 0.00 | 0.00 |

| Net Change in Cash | 28,804.00 | (27,896.00) |

Impact of Capex and Depreciation to the Financial Statements in a Glance