How does capitalised interest distort Interest Coverage ratios?

For you that attended courses like Value Investing 101 or Financial Statements Analysis 101, I am quite sure you have learnt interest coverage ratios. Formula of these ratios are straightforward. Well, what could go wrong with such a simple calculation? In this article, we will discuss one advanced accounting item, Capitalised Interest, which causes impact to interest coverage ratios.

One of the key areas in analysing business risks is we want to assess whether a business afford its debt burden. We use these interest coverage ratios to measure how easily a company can pay their interest expenses on outstanding debt.

- EBIT / Interest Expense

- EBITDA / Interest Expense

- (EBITDA-Capex) / Interest Expense

- (Funds from Operations + Interest Expense)/Interest Expense

Each of above ratios telling us similar message. We take operating profit, then divide it by the interest expense in Income Statement.

Calculation wise, it is quite easy. After you get the interest coverage of a business, you should do peer comparison and loot at historical trends. In general, the higher multiple the better it is. Unfortunately, it is not simple. The devil is in the details.

Capitalised interest

I would like to introduce capitalised borrowing costs, also known as, capitalised interest expense and construction interest expense. This is one type of financial costs that less commonly known by retail investors.

Under IAS 23, one of accounting standards of IFRS, capitalized interest is the cost of the funds, or borrowing costs, used to finance the construction of a long-term asset that a business constructs for itself. For example, a company takes construction loan to construct its new corporate headquarter. The company must be taking construction loan. The borrow funds need not related to specific projects, but it ties to the qualifying long term asset.

How does finance cost capitalised into asset? The finance cost is rolled into the cost of asset, so that the interest is not recognized in the current period as interest expense.

It is now a fixed asset, and is included in the depreciation of the long-term asset. Thus, it initially appears in the balance sheet, and is charged to expense over the useful life of the asset. Therefore, the expenditure appears on the income statement will be depreciation expense, rather than interest expense.

From the perspective of accrual accounting, capitalizing interest helps a user of financial statements obtain an accurate measure of the acquisition cost of an asset and have a better allocation of costs to earnings in the periods when an acquired asset is being used.

When booked, capitalized interest has no immediate effect on a company’s income statement, and instead, it appears on the income statement through a depreciation expense.

As retail investor, we have no access to internal document to verify eligibility of an interest expense for capitalisation. We trust accountants and auditors doing their job. Part of IFRS, the finance cost capitalised during the period should be disclosed in PP&E footnote. The policy, amount capitalized, and rate used should be disclosed too.

Example of capitalised interest

Karex Berhad is a Malaysian condom manufacturer, one of the largest in the world. It produces more than five billion condoms a year and one in every five condoms globally. The company also supplies condoms to marketing brands like Durex.

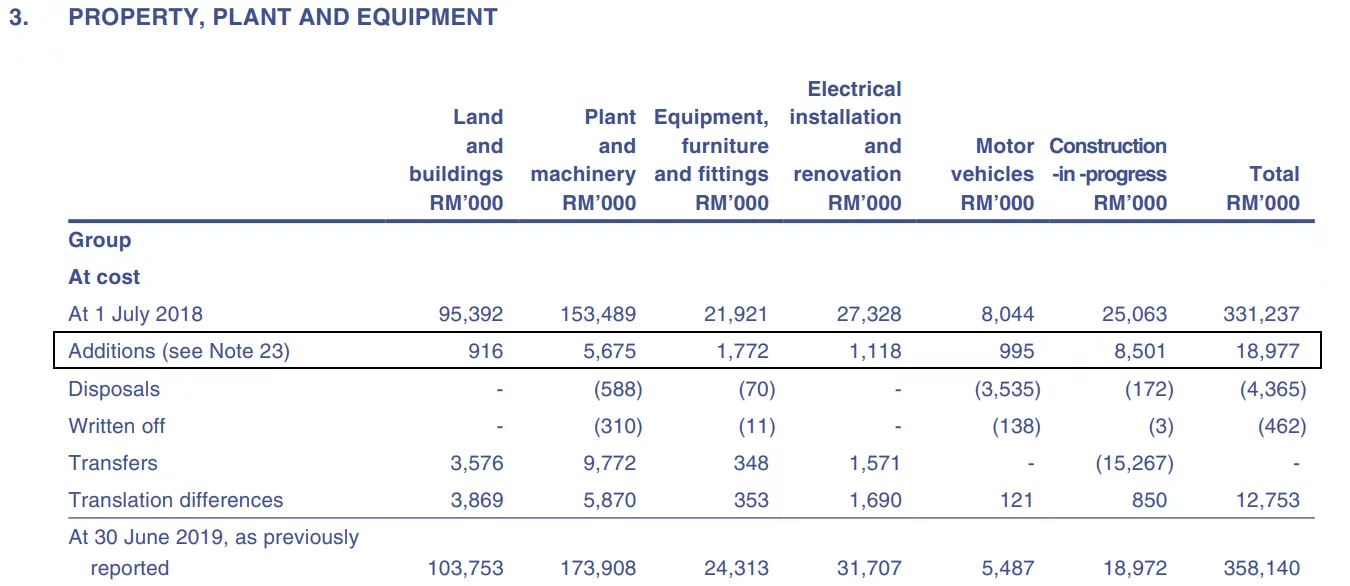

Take Karex’s annual report 2020. Refer to PROPERTY, PLANT AND EQUIPMENT section at page 99, you would see this message:

In prior year, included in buildings of the Group was finance cost capitalised of RM195,000 at 4.18% per annum.

Karex – Annual Report 2020, page 99

What does it mean? It means RM195,000 of construction interest expense was added into additions of PP&E RM18,977 million.

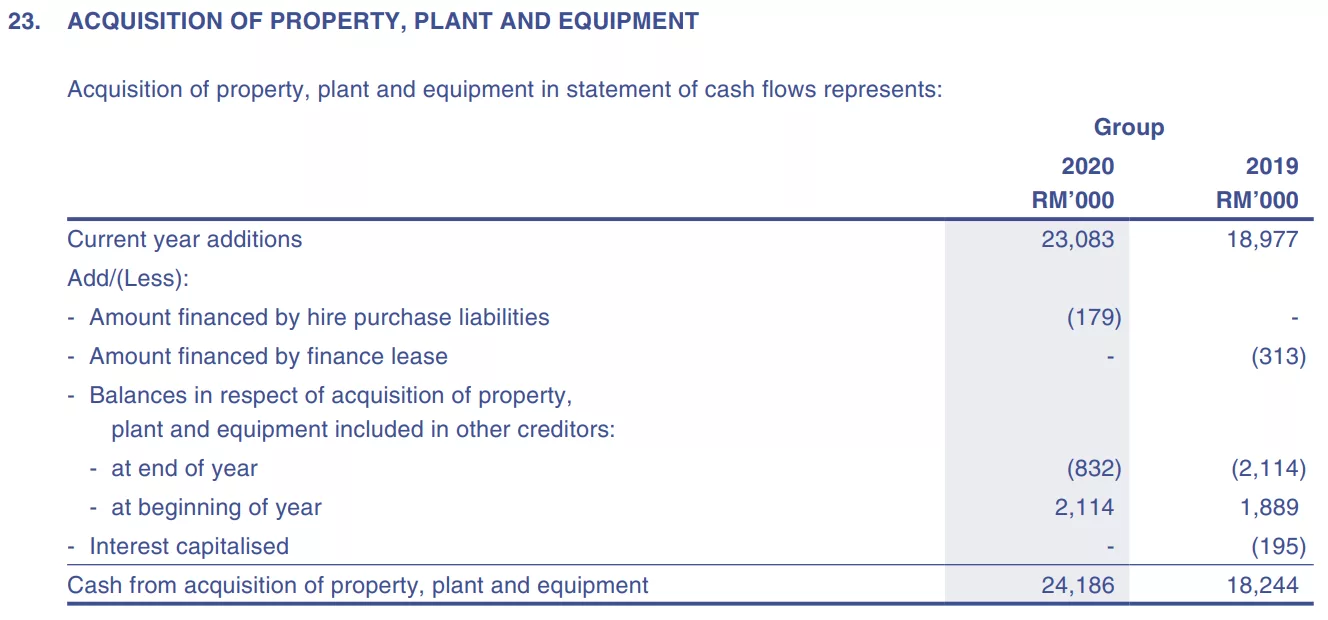

Subsequently, we navigate to the “ACQUISITION OF PROPERTY, PLANT AND EQUIPMENT” section at page 56. To reflect capex properly in the cash flow statement, KAREX removed RM195,000 from the Additions. RM18,244 million is the capex, not RM18,977 million. Not many companies disclose this calculation in footnote.

Because the capitalised interest was added into PP&E, this amount wouldn’t appear in Income Statement. It means the finance costs RM1.424 million didn’t include the capitalised interest RM195,000.

Tenaga Nasional Berhad, also known as Tenaga Nasional or simply Tenaga, is the Malaysian multinational electricity company and is the only electric utility company in Peninsular Malaysia and also the largest publicly-listed power company in Southeast Asia with MYR 182.60 billion worth of assets.

Included in the capital work-in-progress is interest capitalised during the financial year for the Group and the Company of RM274.4 million (2020: RM466.3 million) and RM249.4 million (2020: RM259.6 million) respectively.

Tenaga – Annual Report 2021, page 93

The capitalisation rate used to determine the amount of borrowing cost eligible for capitalisation is 5.3% (2020: 5.5%).

The capitalised interest was RM274.4 million, and the rate was 5.3%. The interest rate is quite high, and this is common for construction loan. The capitalised interest was added to PP&E – RM8,892 million, and it wasn’t appeared in Income Statement. The capitalised interest will be depreciated based on useful life of the asset. The useful life of the asset can be from 10 to 60 years.

Hammerson plc is a major British property development and investment company. The firm switched to real estate investment trust status when they were introduced in the United Kingdom in January 2007.

At page 27 of Annual Report 2021 (Table 25), we see interest capitalised is removed from interest costs. The capitalised interest will be depreciated based on useful life of the asset. Hammerson also provided definition of “Net finance costs” as below:

Net finance costs include interest payable on debt, derivative financial instruments, interest on head leases and other lease obligations, debt and loan facility cancellation costs, net of interest capitalised, interest receivable on funds invested and derivative financial instruments, and changes in the fair value of derivative financial instruments.

Hammerson – Annual Report 2021, page 109

At page 169 (Table 96), Hammerson made adjustment to calculate its interest coverage by adding in capitalised interest.

The Unite Group provides purpose built student accommodation across the United Kingdom. The company is listed on the London Stock Exchange as a constituent of the FTSE 100 Index.

At page 192, Note 3.1 in Annual Report 2019 shows interest capitalised in their investment property under development.

Total interest capitalised in investment properties (owned) and investment properties under development at 31 December 2019 was £47.6 million (2018: £49.8 million) on a cumulative basis. Total internal costs capitalised in investment properties (owned) and investment properties under development was £63.4 million at 31 December 2019 (2018: £59.6 million) on a cumulative basis.

UNITE – Annual Report 2019, page 193

Impact / Issues of capitalised interest

Coverage ratios will be distorted. Companies may hide the actual borrowing costs, thus present higher net income. Capitalised interest will be depreciated together with the fixed asset. What if the useful live of the fixed asset is 30 years…

Add Capitalised Interest into Interest Coverage

Add the capitalised interest into interest expense when calculating interest coverage. If the impact is huge, question the management during AGM.

Key Takeaways

- Finance costs relating to the construction of qualifying assets are capitalized

- The finance cost is rolled into the cost of the asset, instead of being expensed

- It affects P&L in later periods as it is depreciated

- Add the capitalised interest into interest expense when calculating interest coverage

- If the impact is very huge, question the management during AGM.