Financial Derivatives and Hedging

This guide focus on some advanced concepts of financial derivatives and hedging. To learn about the basics of financial derivatives, “What Are Derivatives?” is a good article. If you prefer video, here is a good one: “Financial Derivatives Explained“

Hedging of derivatives is an extremely complicated business activities and involves many different financial risks. Click to view types of financial risk to be disclosed.

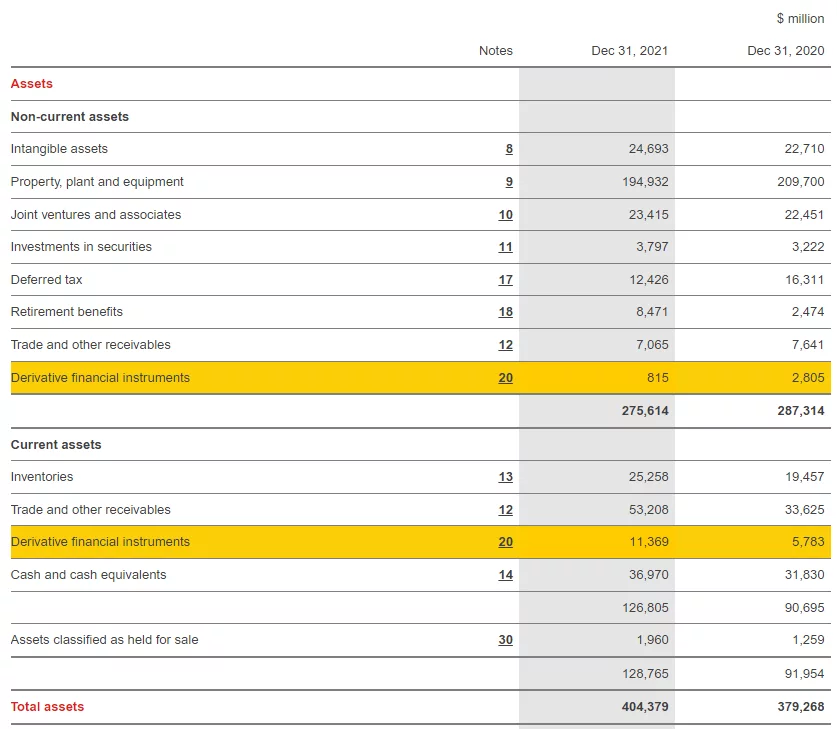

General Accounting Treatment of Derivatives

All derivatives are recorded in the balance sheet at fair value. At a point in time the derivative may be an asset, have zero value or be a liability. For example,

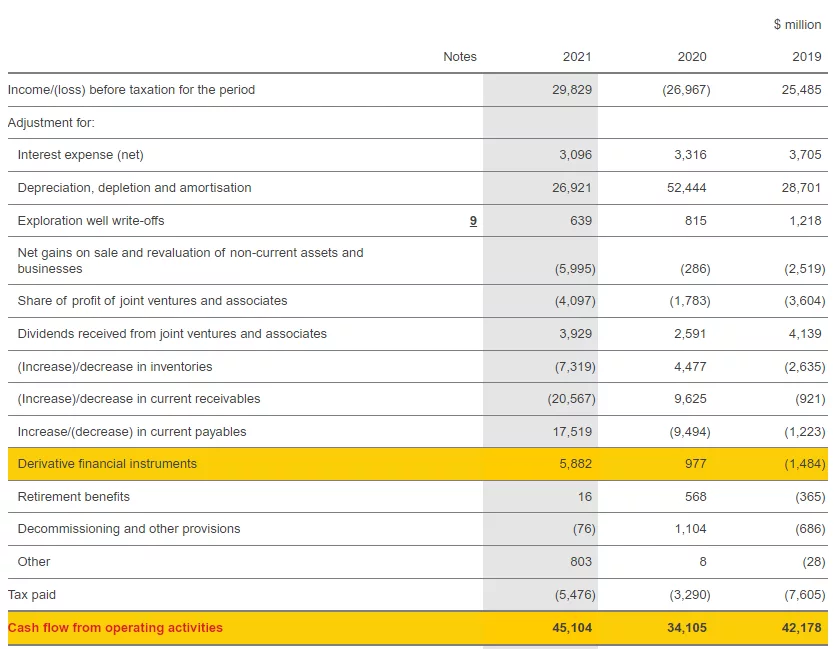

Gains and losses usually appear in the Income Statement. If you couldn’t find gains and losses of derivatives in the Income Statement, you should be able to find them in the Cash flow from operating activities section in the Cash Flow Statement. This is what happened to Shell Global.

The degree of management estimate in the valuations will appear as part of the financial derivatives fair value disclosure table. Company must disclose their accounting policy in recognising the fair value of financial derivatives and its risk management policy. Besides, company must disclose the purpose of holding derivatives, but the purpose is not always clearly disclosed.

The company has choices over how to account for any hedges:

- Determined by what is allowable under the standard

- And what is practical in terms of the company systems and processes.

Click to view Shell Global’s disclose of its accounting policy and risk management policy

Hedge Accounting – Qualification

- Hedge accounting treatments have to be earned

- Clear designation and documentation of hedge, hedging instrument and hedged item

- There are restrictions on the nature of risks to be hedged and the items that qualify as hedging instruments

- The effectiveness of the hedge needs to be tested regularly

- Ineffective hedges are discontinued.

Type of Hedges

Fair Value Hedge

- To lock in the present

- Hedge of exposure to changes in fair value of an existing asset, liability or a firm commitment:

- Value of fixed rate debt security

- Currency exposure on a firmly committed future purchase / sale

In layman’s terms, you have some “fixed item” and you’re worried that its value will fluctuate with the market.

Cash Flow Hedge

- To lock in the future

- Hedge of variability in expected future cash flows attributable to an existing asset or liability or a forecasted transaction:

- Variable interest on debt security

- Currency exposure on a probable future purchase / sale

In layman’s terms, you have some ”variable item” and you’re worried that you might get less money or have to pay more money in the future than now

There is another type of hedge called Hedge of a Net Investment in a Foreign Operation (similar to cash flow hedge). We won’t cover this here.

What do we hedge?

| Item hedged | Risk hedged | Type of hedge |

|---|---|---|

| Fixed-rate assets and liabilities | Interest rates, Fair value, Termination Options | Fair value hedge |

| Fixed-rate assets and liabilities | Foreign currency, credit risk | Fair value hedge or cash flow hedge |

| Unrecognized firm commitments | Interest rates, Fair value, Credit risk | Fair value hedge |

| Unrecognized firm commitments | Foreign currency | Fair value hedge or cash flow hedge |

| Variable-rate assets and liabilities | Fair value, termination options | Fair value hedge |

| Variable-rate assets and liabilities | Interest rates, foreign currencies, credit risk | Cash flow hedge (most cases) |

| Highly probable forecast transactions | Fair value, interest rates, credit risk, foreign currency | Cash flow hedge |

Accounting for Hedges Without “Hedge Accounting”

- On 1-Dec-2016, Company A (currency=MYR) commits to purchasing $34,200 (Currency=USD) of equipment on 31-Mar-2017

- Company A hedges FX risk to date of purchase with forward contract to purchase $34,200 for MYR146,000 (rate of 0.2288:1) for settlement on 31-Mar-2017.

- The exchange rate is 0.21 at 31-Dec-2016 and the FX forward is remeasured with unrealised gain of MYR16,857 recorded in P&L and a corresponding derivative asset on balance sheet

- The exchange rate is 0.20 at 31-Mar-2017 and the FX forward is remeasured with a further gain of MYR25,000

- The equipment is purchased on 31-Mar-2017 at a cost of MYR171,000 and the FX forward settles with net receipt of MYR41,857.

| 31 Dec 2016 | 31 Mar 2017 | |

|---|---|---|

| Balance Sheet | ||

| Assets | ||

| Equipment asset | 171,000 | |

| Cash | 41,857 | |

| Derivative asset | 16,857 | 41,857 |

| Liabilities | ||

| Payable | 171,000 | |

| Income Statement | ||

| Gain on derivative | 16,857 | 25,000 |

What’s wrong with this?

The outcome is a mismatch – Gains are recognised on the hedging instrument in both 2016 and 2017 and the equipment is recognised at the rate prevailing on the acquisition date. Economically the gains on the FX forward offset the additional purchase cost but the accounting does not reflect this.

Accounting for Fair Value Hedge

Rules of Thumb

Example: Fair Value Hedge

- The hedging instrument (the FX forward) is accounted for as normal (fair value through P&L)

- The hedged item is fair valued for the hedged risk – so revalued for FX risk – the fair value gain or loss is taken to P&L and creates an asset or liability equal to the change in the hedged risk.

- The change in value of the hedged item and hedging instruments offset each other in both periods and ultimately the hedged item is recognized at the amount set by the hedge.

| 31 Dec 2016 | 31 Mar 2017 | |

|---|---|---|

| Balance Sheet | ||

| Assets | ||

| Equipment asset | 146,000 | |

| Cash | 41,857 | |

| Derivative asset | 16,857 | 41,857 |

| Liabilities | ||

| Payable | 171,000 | |

| Hedge liability | 16,857 | 41,857 |

| Income Statement | ||

| Gain on derivative | 16,857 | 25,000 |

| Loss on hedged PO | (16,857) | (25,000) |

Accounting for Cash Flow Hedges

Example: Cash Flow Hedge

- The hedged item is accounted for as normal

- The hedging instrument is fair valued through other comprehensive income – a hedge reserve is created

- An amount corresponding to the hedged risk is reclassified from the hedge reserve (through other comprehensive income) and used to either:

- Offset the cost of the hedged item on initial recognition or

- Offset the impact on the income statement relating to the use of the hedged item

- Ineffectiveness arises if the hedged item and hedging instrument do not exactly match – ineffectiveness is booked to P&L

- If ineffectiveness is outside 80/125% the hedge is discontinued.

- The change in value of the hedging instrument is kept out of the income statement. The hedging reserve is used to offset the purchase cost when the asset is acquired (basis adjustment).

| 31 Dec 2016 | 31 Mar 2017 | |

|---|---|---|

| Balance Sheet | ||

| Assets | ||

| Equipment asset | 146,000 | |

| Cash | 41,857 | |

| Derivative asset | 16,857 | 41,857 |

| Liabilities | ||

| Payable | 171,000 | |

| Hedge liability | 16,857 | 41,857 |

| Income Statement | ||

| Gain on derivative | 16,857 | 25,000 |

| Loss on hedged PO | (41,857) |

Guarantees

- Financial guarantees are usually treated as financial instruments and recorded initially at fair value (e.g. at the amount of any premium received)

- Subsequently the guarantee is measured at higher of its initial fair value and the amount

- If probable that the guarantee will be called then a liability for the estimated loss is booked

- If not probable, it will remain at the amount initially booked (fair value). But if material it may be disclosed as a contingent liability.

Types of Financial Risk to be Disclosed

Hedging of derivatives is an extremely complicated business activities and involves many different financial risks. Click to view types of financial risk to be disclosed.