Deferred Tax Explained

Why have Deferred Tax?

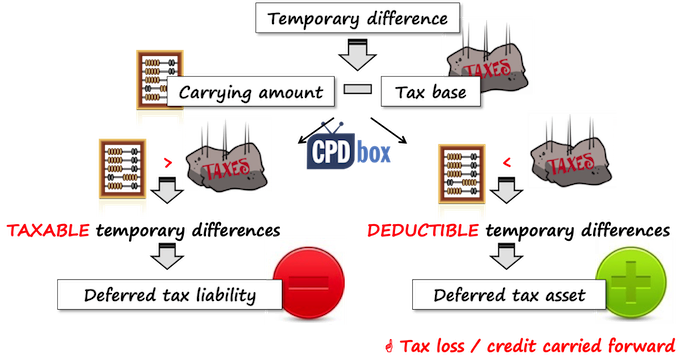

Deferred tax is the accounting concept used to account for the difference between the tax base of an asset or liability and its carrying amount in the financial statements. This difference arises from the fact that the accounting and taxable profiles of an entity may differ, leading to tax charges or credits being recognized in different periods than when the corresponding accounting transactions occur.

Deferred tax is used to recognize the future tax consequences of these differences, so that the total tax charge recognized in the financial statements represents both:

- The actual tax payable on the current year’s taxable profile

- The deferred tax on future taxable profit arising from the current year’s accounting transactions.

In simple terms, deferred tax is a way of accounting for the difference between how much a company reports as income on its financial statements and how much it reports as income to the tax authorities. This difference arises because accounting rules and tax laws don’t always match up. Deferred tax is a way of making sure that a company’s financial statements give an accurate picture of its true income.

For example, if a company spends money on something that can be written off as a business expense for tax purposes, but has to be recorded as an expense on its financial statements right away, it will end up paying less in taxes than it reports as having spent on its financial statements. In this case, the company would have a deferred tax liability. On the other hand, if a company reports income on its financial statements that it can’t claim for tax purposes until later, it will end up paying more in taxes than it reports as having earned on its financial statements. In this case, the company would have a deferred tax asset.

What is the tax base?

- Generally, the account deductible for tax purposes

- If future benefits not taxed, tax base = carrying amount

- The carrying amount less amount deductible for tax.

- For deferred income, tax base = carrying amount – non-taxable future revenues

IFRS has special rules apply to prevent grossing up of assets and liabilities for some “permanent differences”.

Deferred tax created because of temporary differences

| Balance Sheet Item | Taxable Temporary Difference | Deductible Temporary Difference |

|---|---|---|

| Asset | Carrying amount greater than tax base | Tax base greater than carrying amount |

| Liability | Tax base greater than carrying amount | Carrying amount greater than tax base |

Deferred tax liability

- Taxable temporary differences x% tax rate

- Increase future taxable income on recovery or settlement of asset / liability.

- if some of those taxes are being deferred to future periods, we generate MORE cash than our Net Income implies in this current period

Deferred tax asset

- Deductible temporary difference x% tax rate

- Reduce future taxable income on recovery or settlement of asset / liability.

- Tax losses and tax credits carried forward

- Tests must be performed to ensure deferred tax assets are not carried above their recoverable amount.

- If we must pay MORE in cash taxes in this period, we generate LESS cash than our Net Income implies.

- It’s best to think of a Deferred Tax Liability NOT as “what you owe the government in the future,” but more “a timing difference in tax payments”

If you prefer something more “accounting”, here you are: IAS 12 – Income Taxes.

Illustration of Taxable Temporary Differences on Tax Deductible Equipment

- A company purchases equipment with a cost of $1,000. For financial reporting purposes, it has a life of 5 years, nil residual value and is depreciated straight line.

- The company is subject to income tax at 30% and the cost of equipment is tax deductible. The annual allowance is at the rate of 50% of the carrying amount.

- Assume accounting and taxable profile before the effect of the asset purchase is $1,000 in each year.

Tax Accounts and Financial Statements

| Tax Rate 30% | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Explanation |

|---|---|---|---|---|---|---|

| Tax Accounts | ||||||

| Asset (tax base) | 1,000 | 500 | 250 | 125 | 63 | Asset value of current year = Asset value of previous year – tax depreciation of previous year |

| Tax depreciation | 500 | 250 | 125 | 63 | 31 | Depreciated 50% every year |

| Profit before tax and depreciation | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | Assume 1,000 every year |

| Taxable profit (net tax depreciation) | 500 | 750 | 875 | 938 | 969 | Profit before tax and depreciation – Tax depreciation |

| Tax payable at 30% | 150 | 225 | 263 | 281 | 291 | Taxable profit * 30% |

| Financial Statements | ||||||

| Asset (carrying value) | 1,000 | 800 | 600 | 400 | 200 | Asset value of current year = Asset value of previous year – accounting depreciation of previous year |

| Accounting depreciation | 200 | 200 | 200 | 200 | 200 | Asset value of Year 1 / 5 years and depreciated over 5 years |

| Accounting profit before tax | 800 | 800 | 800 | 800 | 800 | Profit before tax and depreciation – Accounting depreciation |

| Tax payable | 150 | 225 | 263 | 281 | 291 | |

| Deferred tax | 90 | 15 | -23 | -41 | -51 | Tax Charge (accrual basis) – Tax Payable at 30% |

| Tax charge (accrual basis) | 240 | 240 | 240 | 240 | 240 | Accounting profit before tax * 30% |

| Deferred tax liability / (asset) | 90 | 105 | 83 | 41 | -9 | Deferred Tax of previous year + Deferred Tax of current year |

Accounting Entries

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Explanation | |

|---|---|---|---|---|---|---|

| On acquisition | ||||||

| Carrying amount | 1,000 | |||||

| Tax base | -1,000 | |||||

| Taxable temporary difference | 0 | |||||

| Subsequently at end of each year | ||||||

| Carrying amount | 800 | 600 | 400 | 200 | 0 | Asset (carrying value) – Accounting Depreciation |

| Tax base (tax depreciation) | 500 | 250 | 125 | 63 | 31 | Depreciated 50% every year |

| Taxable temporary difference | 300 | 350 | 275 | 138 | -31 | Carrying amount – Tax base |

| Deferred tax at 30% | 90 | 105 | 83 | 41 | -9 | Taxable temporary difference * 30% |

| Entries | ||||||

| Dr Deferred tax charge | 90 | 15 | -23 | -41 | -51 | Deferred tax of current year – Deferred tax of previous year |

| Cr Deferred tax liability | 90 | 15 | -23 | -41 | -51 | Deferred tax of current year – Deferred tax of previous year |

| Deferred tax liability balance | 90 | 105 | 83 | 41 | -9 | Taxable temporary difference * 30% |

Illustration of Deductible Temporary Difference on Provision

- A company sets up a provision of $1,000 which is tax deductible against profits when the provision is paid in 5 years’ time.

- Ignore effect of discounting.

- The company is subject to income tax at 30%.

- Assume accounting and taxable profit before the effect of the provision is $1,000 in each year.

Tax Accounts and Financial Statements

| Tax Rate 30% | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Explanation |

|---|---|---|---|---|---|---|

| Tax Accounts | ||||||

| Liability (tax base) | 0 | 0 | 0 | 0 | 1000 | The provision is paid in 5 years’ time |

| Profit before provision & tax | 1000 | 1000 | 1000 | 1000 | 1000 | Assume 1,000 every year |

| Provision paid (tax deductible) | -1000 | |||||

| Taxable profit | 1000 | 1000 | 1000 | 1000 | 0 | Profit before provision & tax – Provision paid |

| Tax payable at 30% | 300 | 300 | 300 | 300 | 0 | Taxable profit * 30% |

| Financial statements | ||||||

| Liability financial statements | 1000 | 1000 | 1000 | 1000 | 0 | Year 1: 1,000 allocated; Year 2 to 4: carrying amount; Year 5: the provision paid. |

| Accounting profit before tax | 0 | 1000 | 1000 | 1000 | 1000 | Year 1: Profit before provision & tax – Year 1 of provision |

| Tax payable | 300 | 300 | 300 | 300 | 0 | |

| Deferred tax | -300 | 0 | 0 | 0 | 300 | Tax charge (accruals basis) – Tax payable |

| Tax charge (accruals basis) | 0 | 300 | 300 | 300 | 300 | Accounting profit before tax * 30% |

| Deferred tax asset | 300 | 300 | 300 | 300 | 0 | Deferred tax of current year – Deferred tax of previous year |

Accounting Entries

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Explanation | |

|---|---|---|---|---|---|---|

| On recognition of liability | ||||||

| Carrying amount | 1,000 | |||||

| Tax base | 0 | |||||

| Deductible temporary difference | 1,000 | |||||

| Subsequently at end of each year | ||||||

| Carrying amount | 1,000 | 1,000 | 1,000 | 1,000 | 0 | Same with Liability financial statements |

| Tax base | 0 | 0 | 0 | 0 | 1,000 | Same with liability (tax base) |

| Deductible temporary difference | 1,000 | 1,000 | 1,000 | 1,000 | -1,000 | Carrying amount – tax base |

| Deferred tax asset at 30% | 300 | 300 | 300 | 300 | -300 | Deductible temporary difference * 30% |

| Entries | ||||||

| Dr Deferred tax asset | 300 | 0 | 0 | 0 | -300 | Year 1: 300 added; Year 5: 300 removed |

| Cr Deferred tax credit | 300 | 0 | 0 | 0 | -300 | Year 1: 300 added; Year 5: 300 removed |

| Deferred tax asset balance | 300 | 300 | 300 | 300 | 0 | Deferred tax of current year – Deferred tax of previous year |

Considerations in Analysing Deferred Tax

- Need to consider:

- Will deferred tax liabilities really result in future tax cash outflows?

- i.e. accelerated capital allowances in a growing company

- On liquidation?

- Will deferred tax assets become recoverable through reductions in future taxes?

- May relate to long term liabilities; such as pensions and asset retirement obligations

- What consequences might there be if entities pay up dividends?

- If there are tax consequences of dividends being paid these may not be recognised if the parent controls the timing and amount of these

- Will deferred tax liabilities really result in future tax cash outflows?

- Generally, treat deferred tax liabilities (or assets) which are of a permanent nature as if equity.

- If making adjustments to assets or liabilities, should consider the deferred tax consequence too.