What is recourse obligation on loans and financing sold to Cagamas/investors?

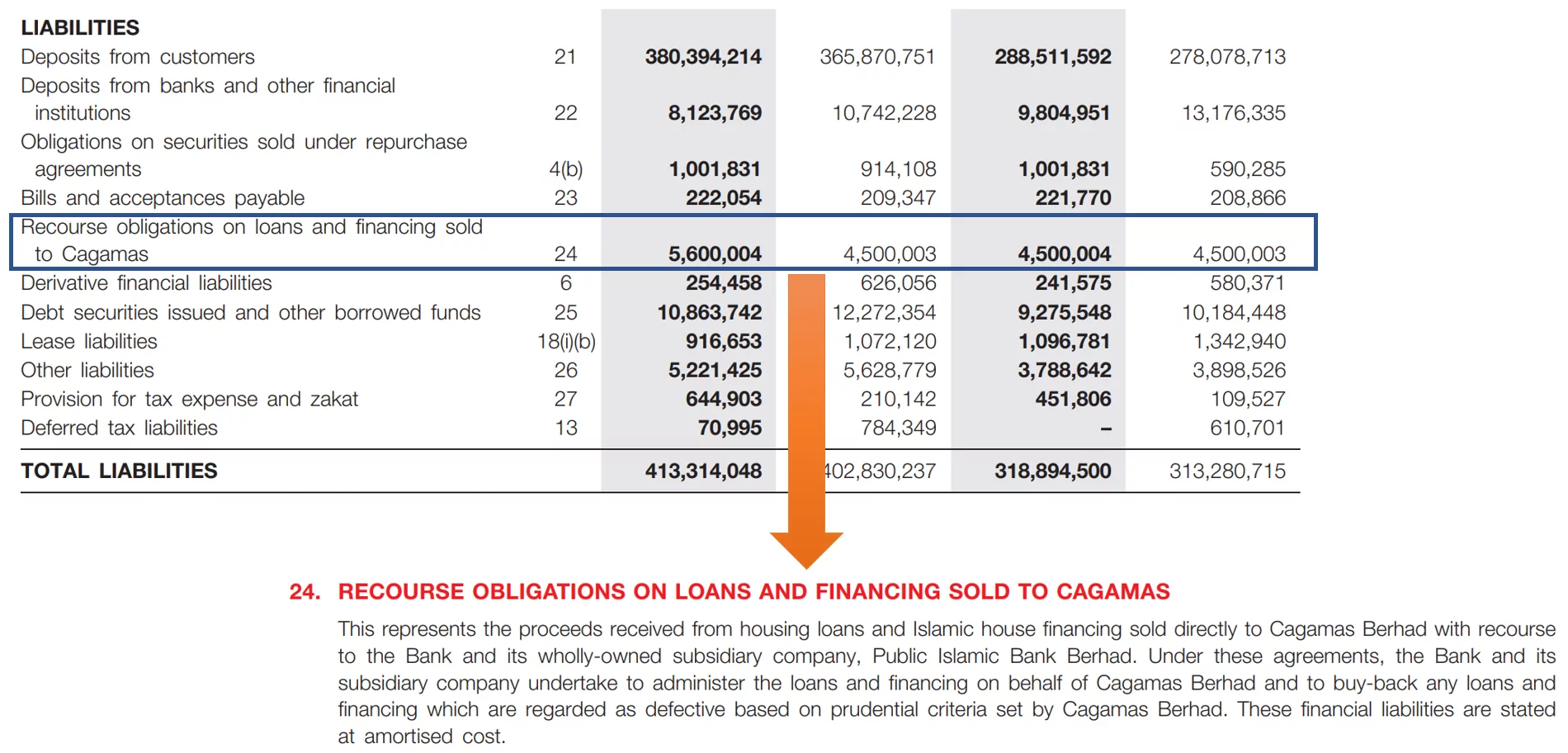

If you ever read annual report of public listed commercial banks in Malaysia, you will always see “Recourse obligations on loans and financing sold to Cagamas” in the Liabilities side of their Balance Sheet. Footnote of this item usually doesn’t help much unless you understand the concept of this debt security. You come to the right place to learn the concept of this debt security. Banks use this kind of loan securitization to raise funds.

About Cagams Berhad

Cagamas Berhad (Cagamas), the National Mortgage Corporation of Malaysia, was established in 1986 to promote the broader spread of home ownership and growth of the secondary mortgage market in Malaysia. It issues corporate bonds and sukuk to finance the purchase of housing loans and receivables from financial institutions, selected corporations and the public sector. The provision of liquidity at a reasonable cost to the primary lenders of housing loans encourages further financing of houses at an affordable cost. (About Cagamas)

In layman terms, Cagamas Berhad is a government-owned corporation in Malaysia that helps to promote and develop the country’s housing market. It does this by buying mortgages and other housing loans from banks and other financial institutions. These mortgages and loans are then packaged into securities, which are sold to investors, similar to stocks or bonds.

By buying mortgages and loans from banks, Cagamas helps free up money that banks can use to make new loans to people who want to buy a home. This makes it easier for people to obtain mortgages and buy homes, which can boost the country’s housing market.

Cagamas also offers investors a way to make money by buying securities backed by mortgages and loans. These securities yield a return, similar to bonds, and can be bought and sold on the open market. However, it’s important to know that the securities are backed by mortgages and loans, so the performance of the securities depends on the performance of the underlying mortgages and loans, and this can be affected by economic and market conditions.

What is secondary mortgage market?

The secondary mortgage market refers to the buying and selling of mortgages after they have been originated by a lender. In the secondary market, mortgages are bought and sold in the form of mortgage-backed securities (MBS), which are financial instruments that represent a pool of mortgages. A MBS is a type of financial instrument that is created by pooling together mortgages and then selling shares in that pool to investors.

The secondary mortgage market allows mortgages to be transferred from the original lender to investors, which can have a number of benefits. For example, lenders can free up capital that can be used to originate new mortgages, and investors can earn a return on their investments by purchasing MBS.

There are a few several types of secondary mortgage market participants, including:

- Government Sponsored Enterprises (GSEs): These are organizations such as Fannie Mae and Freddie Mac that were created by the government to promote stability and liquidity in the secondary mortgage market. They buy mortgages from lenders and package them into MBS, which are then sold to investors.

- Private-Label Securitization: These are securities that are issued by private companies, rather than government-sponsored enterprises. They are like GSE securities, but they are not backed and not guaranteed by the government.

- Secondary Market Investors: These include pension funds, insurance companies, and other institutional investors that purchase MBS in the secondary market.

The secondary mortgage market plays a significant role in providing liquidity and stability to the housing market by allowing lenders to originate mortgages and investors to purchase them. It also enables to spread the risks across different investors, which can help to reduce the overall risk in the housing market. However, the secondary market also has its own set of risks and investors should carefully evaluate the risk associated with any investment in the secondary mortgage market.

Recourse obligation on loans and financing sold to Cagamas

“Recourse obligation on loans and financing sold to Cagamas” refer to the rights and responsibilities of the seller of the loans to repurchase or make whole the loans if certain conditions are not met by the borrower or if there is a breach of representations or warranties made by the seller at the time of the sale.

When banks sell loans to Cagamas, they may retain some level of recourse obligations, which means that they remain responsible for the loans in certain circumstances. This can include situations where the borrower defaults on the loan, or where there is a material breach of representations or warranties made by the seller at the time of the sale. The extent of the recourse obligations will depend on the terms of the sale agreement between the financial institution and Cagamas.

Put in other words, as part of the sale agreement, banks retain a recourse obligation to repurchase any mortgages that default within the first year of the sale. If a borrower of a bank defaults on their mortgage within the first year, the bank is responsible for repurchasing the mortgage from Cagamas and covering any associated losses. This type of recourse obligation helps to protect Cagamas from potential losses on the loans and aligns the interests of the financial institution and Cagamas.

Retention of recourse obligations is common practice in loan securitization as it aligns the interests of the originator and the investor and enables a better pricing of the risk.

What are the risks?

The risk associated with recourse obligations depends on the specific terms of the sale agreement and the creditworthiness of the borrowers:

- Credit Risk: If the borrowers of the loans and financing are not creditworthy and have a high likelihood of defaulting, banks may be required to repurchase a significant number of loans and financing, resulting in significant financial losses.

- Repurchase Risk: If a bank is required to repurchase a large number of loans and financing, it may have difficulty raising the necessary funds to do so, which could put additional strain on its financial position.

- Operational Risk: A bank may also face operational risks in managing the process of repurchasing loans and financing, such as difficulty in finding and contacting the borrowers, legal disputes, and administrative errors.

- Impact on Capital: If a bank must repurchase huge amount of loans and financing, it may have a negative impact on its capital, which could lead to a reduction in its credit rating and make it more difficult to raise funds in the future.

- Impact on Earnings: If a bank must repurchase huge amount of loans and financing, it will have a negative impact on its earnings and its ability to generate profit.

What about in the US market?

Loan securitization is common in the securitization market in the US, where loans and other financial assets are packaged into securities and sold to investors.

In the U.S., recourse obligations are typically included in the terms of sale agreements between the lender (e.g., a bank) and the purchaser of the securities (e.g., an investment company). These agreements may require the originator to repurchase or return loans that fail to meet certain underwriting standards or that default. These agreements may also contain warranties and representations about the loans that, if found to be false or inaccurate, require the originator to repurchase the loan.

Recourse obligations serve to align the interests of the originator and the investor and provide some protection to the investor in the event of a loan default or breach of representations and warranties.

However, not all securitization transactions involve recourse obligations, and the extent of recourse obligations may vary depending on the transaction. Some banks may have more recourse obligations in their securitization transactions than others. It’s important for investors to understand the terms of each securitization transaction and the extent of the recourse obligations before investing in securities.

What about in the Europe market?

Recourse obligations are also common in the securitization market in Europe. In Europe, there is also a regulatory requirement for originators to retain a massive portion of the risk of the securitized assets to align their interests with the investors and to better control the credit quality of the assets. This is known as the “skin-in-the-game” rule.