Loan Impairment in Commercial Banks – How does it work?

Wonder how does loan impairment work in commercial banks? It is complicated, but I do my best to elaborate the mechanism with videos and simple manner. If the mechanism is as simple as normal companies, every entrepreneur can run a bank.

Let say, we run a bank. Below is the Balance Sheet of our bank.

In 2022, we didn’t receive repayment for Loan A $20 for months. We decided to allocate allowance of $5. The following video shows how we classify the allowance and demonstrate its impact to the Income Statement and the Balance Sheet.

In 2022, we didn’t receive repayment for Loan B $10 for months. We decided to allocate allowance of $2, and no charge off for Loan A.

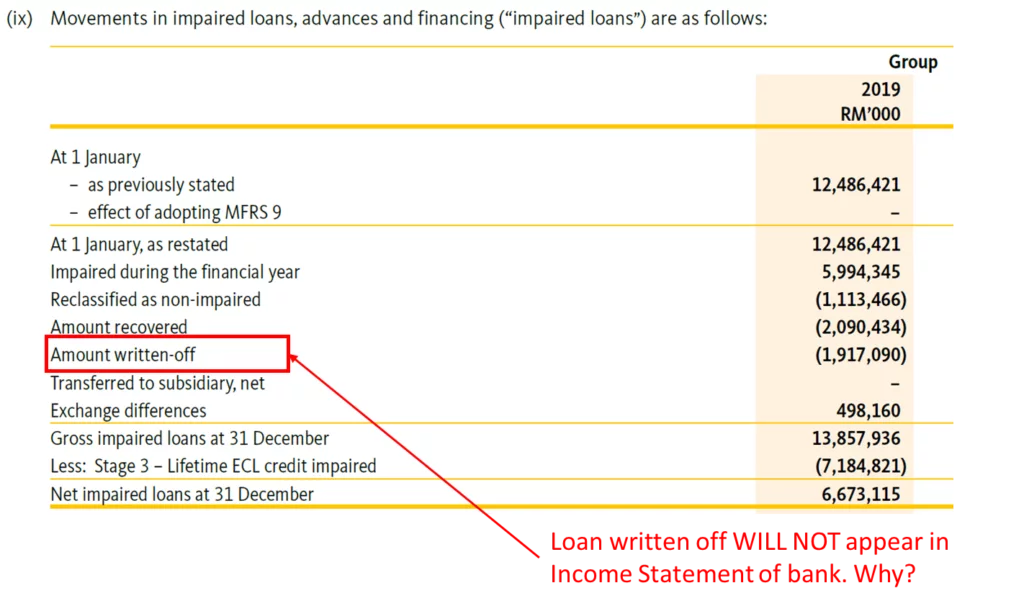

Loan Written/Charge Off

Unlike normal companies, do you every notice loan written off never appear in Income Statement of banks. It appears in Movements in Impaired Loans instead.

Gross Loans is a normal Asset shown with a positive sign, and the Allowance for Loan Losses is a contra-Asset shown with a negative sign. Net Charge-Offs reduce Gross Loans but increase the Allowance, so the changes cancel out. In other words, Net Charge-Offs affect both the Gross Loans and the Allowance for Loan Losses on the Balance Sheet, so there’s no net impact on the Net Loans figure.

If there’s a huge, unanticipated Charge-Off for which the bank has not set aside reserves, the bank will increase its Provision for Credit Losses in response.

Complicated? Yes, definitely. Below video is an illustration of how Loan Written/Charge Off work.

Here’s the math:

- Ending Gross Loans: Increases by the $100 addition to Gross Loans and decreases by the $3 in Net Charge-Offs. The Net Increase is $97.

- $1,000 + $100.0 – $3.0

- Ending Allowance for Loan Losses: It’s already negative, and it decreases by the $5 Provision for CLs and increases by the $3 in Net Charge-Offs. The Provision for CLs reduces it to ($15), and the Net Charge-Offs increase it to ($12). The Net Increase is ($2).

- $(10.0) + $(5.0) – $(3.0) = $(10.0) + $(5.0) + $3.0

As a result, we can say:

- Ending Net Loans = Old Net Loans + Additions to Loans – Provisions for Credit Losses

- Ending Net Loans = $990 + $100 – $5 = $1,085

Impaired Loans Accounting Issues

US GAAP

SFAS 114: Loan impaired when: “Based on current information and events, probable that creditor will be unable to collect all amounts due according to contractual terms of the loan agreement.”

Impaired loans disclosure:

- Non-performing loans (usually >= 90 days overdue)

- Restructured loans

- Watchlist or potential problem loans

IFRS

IAS 39/IFRS 9: Loan impaired when: “Losses are incurred, i.e. objective evidence of impairment (loss event)”

Estimate impact on future cash flows: for example, loan could be overdue but not impaired if collateral is deemed to be worth more than the loan.

Impairment allowance:

- Difference between carrying amount and present value of estimated future cash flows

- Discounted at original effective interest rate, such as effective interest rate at initial recognition.

What is the impact of IFRS 9 ECL to commercial banks?

The ECL model requires banks to estimate lifetime expected credit losses on financial assets, not just credit losses incurred up to the reporting date. This may result in higher allowances and thus a decrease in reported profits. Click to learn more about IFRS 9 Expected Credit Loss.

What should retail investors focus on loan impairment in banks?

Retail investors should focus on loan impairment when evaluating a commercial bank as a potential investment for several reasons:

- Loan impairment can have a significant impact on a bank’s financial performance and profitability. A high level of loan impairment can lead to increased provisions and a reduction in net income.

- The level of loan impairment can be an indicator of a bank’s credit risk management practices. Banks with strong credit risk management practices are less likely to experience high levels of loan impairment.

- The bank’s allowance for loan and lease losses (ALLL) can provide insight into management’s view of the bank’s loan portfolio. A high ALLL may indicate that management expects a significant amount of loan impairment in the future.

- The bank’s loan loss coverage ratio (LLCR) can be used as an indicator of the bank’s ability to absorb loan losses. The LLCR is calculated by dividing the ALLL by the bank’s nonperforming loans. A higher LLCR indicates that the bank has a larger buffer to absorb potential loan losses.

- Retail investors should also look at the bank’s credit quality, it’s geographical and sectoral diversification, and overall risk profile.

It’s important for retail investors to keep in mind that loan impairment can be affected by many factors including economic conditions, industry trends, and the bank’s own practices, so it’s important to take a holistic view of a bank’s financials and operations when evaluating it as an investment.

Impaired loan definitions

Non-performing loans (NPLs)

- Principal/interest payment past due for defined period

- Defined period can vary by country

- Common standard: > 90 days past due

- IFRS includes individually impaired loans

Restructured loans/troubled debt restructurings (TDR)

- Loans accruing at interest rates different from original terms

- Forgiveness of principal and/or accrued interest

- Receipt of an equity interest from the borrower

Potential problem loans/watchlist or vulnerable loans

- Management’s judgement of high level of doubt as to timing/certainty of principal repayment

- Principal and/or interest payments may be past due up to 90 days or may be fully current

- May remain classified as problem beyond 90 days if the loan is well secured and/or in the process of collection

- Under IFRS – defined as “collective” impairments.

Accrual Status

Under IFRS

Interest is to be accrued on all loans, even those that are considered impaired, at the original effective interest rate. It will be offset by increase in loan impairment charge. For example:

US GAAP

- Non-accrual loans

- Loans which have been placed on a cash basis for recognition of receipt of interest and/or principal

- Accruing non-performing loans

- Interest continues to accrue in the income statement even if it has not been received

- Accrued interest receivable shown as asset.

Impaired loans – terminology used

- Impairment charge/loan loss provision (Income Statement):

- Non-cash charge to earnings to create the impairment reserve

- Loan impairment allowance/loan loss reserve (Balance Sheet):

- Contra-asset deducted from gross loans

- Individual impairment: related to a specific asset (usually tax deductible)

- Collective impairment: covers a pool of assets

- Levels differ greatly between countries and institutions

- Charge-off/write-off:

- Deduction to both the loan impairment reserve and the loan book

- Usually done when no possibility of recovering principal

- Timing of this can differ significantly

- Recovery:

- Principal received after loan or portion of loan is written off

- Typically related to loans written off in previous years.