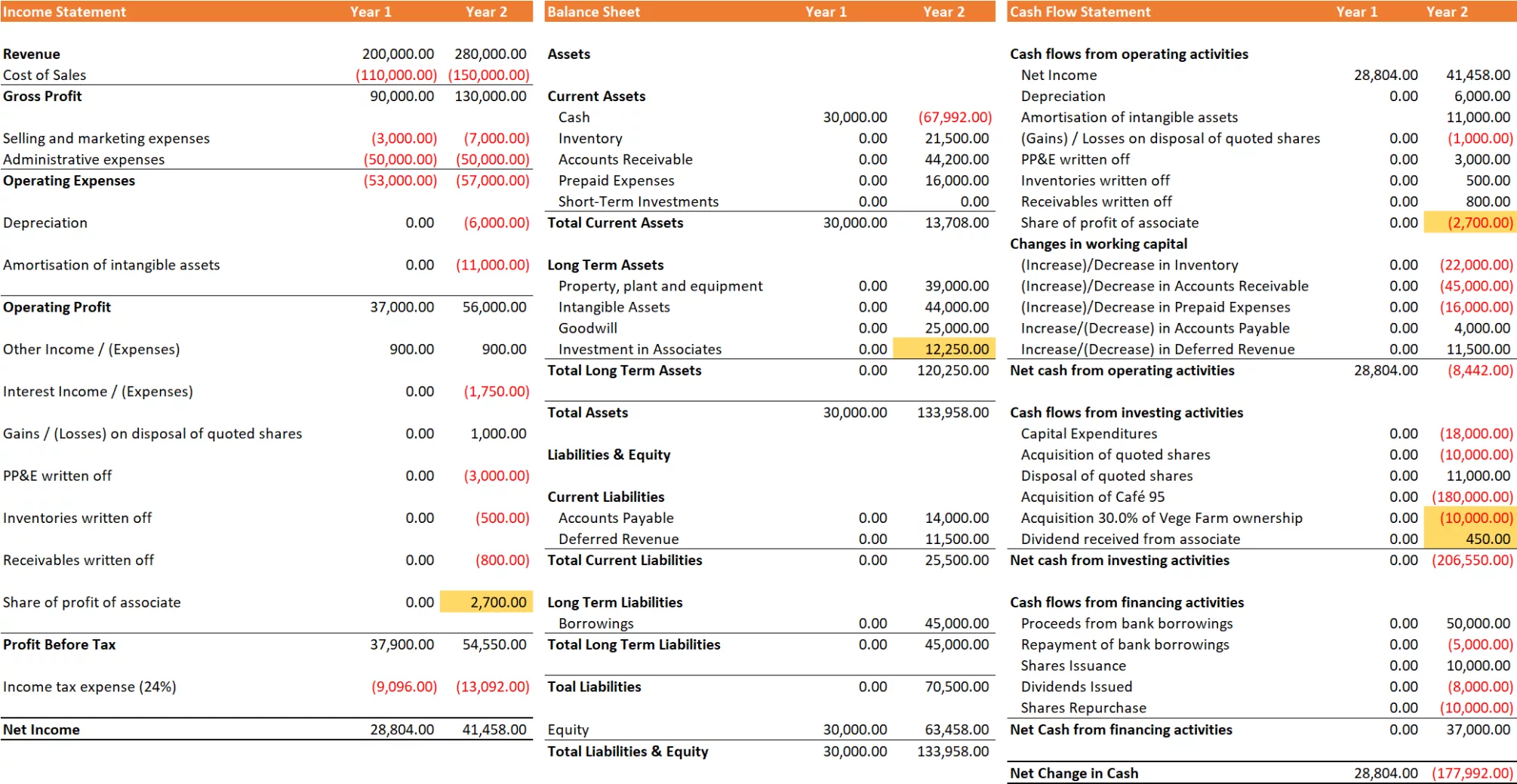

Dividends received from and Share of Results of Associates

Recap: Organic Food Everyday bought 30% of Vege Farm shares with $10,000 (assume $1.00 per share, 10,000 units of Vege Farm shares), and Vege Farm became associates of Organic Food Everyday. How do we record return of investment in Vege Farm?

Let say, Vege Farm made $9,000 net income and distribute $1,500 total dividends to shareholders. To reiterate, we owned 30% of Vege Farm shares. Accounting for investment in associates is done using the equity method. In the equity method, there is not a 100% consolidation used. Instead, the proportion of shares owned by the investor will be shown as an investment in accounting.

First, we need to record Share of Profit of Associate in our Income Statement. The amount of Share of Profit of Associate will be $9,000 x 30% = $2,700.

| Income Statement | Year 1 | Year 2 |

| Revenue | 200,000.00 | 280,000.00 |

| Cost of Sales | (110,000.00) | (150,000.00) |

| Gross Profit | 90,000.00 | 130,000.00 |

| Selling and marketing expenses | (3,000.00) | (7,000.00) |

| Administrative expenses | (50,000.00) | (50,000.00) |

| Operating Expenses | (53,000.00) | (57,000.00) |

| Depreciation | 0.00 | (6,000.00) |

| Amortisation of intangible assets | 0.00 | (11,000.00) |

| Operating Profit | 37,000.00 | 56,000.00 |

| Other Income / (Expenses) | 900.00 | 900.00 |

| Interest Income / (Expenses) | 0.00 | (1,750.00) |

| Gains / (Losses) on disposal of quoted shares | 0.00 | 1,000.00 |

| PP&E written off | 0.00 | (3,000.00) |

| Inventories written off | 0.00 | (500.00) |

| Receivables written off | 0.00 | (800.00) |

| Share of profit of associate | 0.00 | 2,700.00 |

| Profit Before Tax | 37,900.00 | 51,850.00 |

| Income tax expense (24%) | (9,096.00) | (12,444.00) |

| Net Income | 28,804.00 | 39,406.00 |

Subsequently, Share of Profit of Associate is a non-operating item where we don’t actually need Vege Farm to run our core business. Therefore, we must adjust Share of Profit of Associate in the Cash flows From Operating Activities section.

We also need to record dividend received from Vege Farm in the Cash Flows from Investing Activities section: $450 = $1,500 (total dividends to shareholders) x 30%. The dividend received is not taxable, so it won’t appear in the Income Statement.

| Cash Flow Statement | Year 1 | Year 2 | Explanation |

|---|---|---|---|

| Cash flows from operating activities | |||

| Net Income | 28,804.00 | 39,406.00 | |

| Depreciation | 0.00 | 6,000.00 | |

| Amortisation of intangible assets | 11,000.00 | ||

| (Gains) / Losses on disposal of quoted shares | 0.00 | (1,000.00) | |

| PP&E written off | 0.00 | 3,000.00 | |

| Inventories written off | 0.00 | 500.00 | |

| Receivables written off | 0.00 | 800.00 | |

| Share of profit of associate | 0.00 | (2,700.00) | Share of Profit of Associate is a non-operating item where we don’t actually need Vege Farm to run our core business |

| Changes in working capital | |||

| (Increase)/Decrease in Inventory | 0.00 | (22,000.00) | |

| (Increase)/Decrease in Accounts Receivable | 0.00 | (45,000.00) | |

| (Increase)/Decrease in Prepaid Expenses | 0.00 | (16,000.00) | |

| Increase/(Decrease) in Accounts Payable | 0.00 | 4,000.00 | |

| Increase/(Decrease) in Deferred Revenue | 0.00 | 11,500.00 | |

| Net cash from operating activities | 28,804.00 | (10,494.00) | |

| Cash flows from investing activities | |||

| Capital Expenditures | 0.00 | (18,000.00) | |

| Acquisition of quoted shares | 0.00 | (10,000.00) | |

| Disposal of quoted shares | 0.00 | 11,000.00 | |

| Acquisition of Café 95 | 0.00 | (180,000.00) | |

| Acquisition 30.0% of Vege Farm ownership | 0.00 | (10,000.00) | |

| Dividend received from associate | 0.00 | 450.00 | $450 = $1,500 (total dividends to shareholders) x 30%. |

| Net cash from investing activities | 0.00 | (206,550.00) | |

| Cash flows from financing activities | |||

| Proceeds from bank borrowings | 0.00 | 50,000.00 | |

| Repayment of bank borrowings | 0.00 | (5,000.00) | |

| Shares Issuance | 0.00 | 10,000.00 | |

| Dividends Issued | 0.00 | (8,000.00) | |

| Shares Repurchase | 0.00 | (10,000.00) | |

| Net Cash from financing activities | 0.00 | 37,000.00 | |

| Net Change in Cash | 28,804.00 | (180,044.00) |

Lastly, we need to adjust book value of our investment in Vege Farm in the Balance Sheet. The new book value of Investment in Associates will be:

$10,000 (Acquisition 30.0% of Vege Farm ownership) + $2,700 (Share of profit of associate) – $450 (Dividend received from associate) = $12,250.

| Balance Sheet | Year 1 | Year 2 | Explanation |

|---|---|---|---|

| Assets | |||

| Current Assets | |||

| Cash | 30,000.00 | (70,044.00) | |

| Inventory | 0.00 | 21,500.00 | |

| Accounts Receivable | 0.00 | 44,200.00 | |

| Prepaid Expenses | 0.00 | 16,000.00 | |

| Short-Term Investments | 0.00 | 0.00 | |

| Total Current Assets | 30,000.00 | 11,656.00 | |

| Long Term Assets | |||

| Property, plant and equipment | 0.00 | 39,000.00 | |

| Intangible Assets | 0.00 | 44,000.00 | |

| Goodwill | 0.00 | 25,000.00 | |

| Investment in Associates | 0.00 | 12,250.00 | $10,000 (Acquisition 30.0% of Vege Farm ownership) + $2,700 (Share of profit of associate) – $450 (Dividend received from associate) |

| Total Long Term Assets | 0.00 | 120,250.00 | |

| Total Assets | 30,000.00 | 131,906.00 | |

| Liabilities & Equity | |||

| Current Liabilities | |||

| Accounts Payable | 0.00 | 14,000.00 | |

| Deferred Revenue | 0.00 | 11,500.00 | |

| Total Current Liabilities | 0.00 | 25,500.00 | |

| Long Term Liabilities | |||

| Borrowings | 0.00 | 45,000.00 | |

| Total Long Term Liabilities | 0.00 | 45,000.00 | |

| Toal Liabilities | 0.00 | 70,500.00 | |

| Equity | 30,000.00 | 61,406.00 | |

| Total Liabilities & Equity | 30,000.00 | 131,906.00 |

Impact of Dividends received from and Share of Results of Associates to the Financial Statements in a Glance